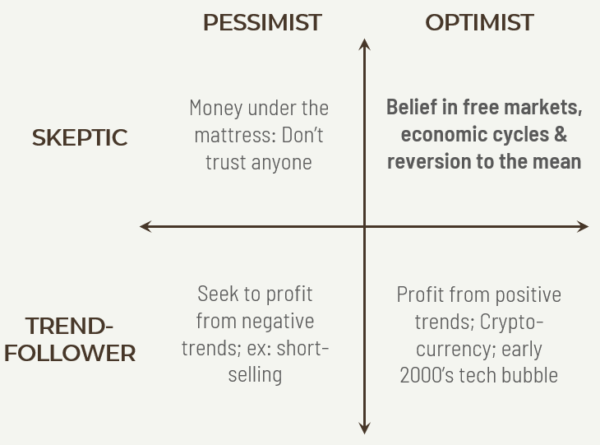

It’s pretty easy to succumb to cynicism and pessimism in the current environment. Nearly 60% of people believe the U.S. is on the wrong track. Trust in institutions is at or near all-time lows. Scandals, natural disasters, and mass violence are all too prevalent. If you start to extrapolate that out into the future, your perspective can get bleak pretty quickly. As an investor, the problem with succumbing to cynicism and negativity is that it can invalidate the whole premise of long-term planning. After all, it’s difficult to invest for the long run if you believe the whole system is doomed in the long run. (Recent polls show a majority of younger Americans have a negative view of capitalism.) The Benefits of Prosperity A helpful way to remain rationally optimistic is to look at all the trials we’ve come through in the past. As the economist James Buchanan is purported to have said, “When I look to the future, I’m a pessimist. When I look to the past, I’m an optimist.” Since 1800 the average life expectancy has nearly doubled, and real income has increased roughly tenfold. In 1900 almost no one had running water, central heating, electric washing machines, and refrigerators. Today, of those Americans officially designated as “poor”, 99% have electricity, running water, flush toilets, and refrigerators. Rivers, lakes, and air are all getting cleaner. Over the last 60 years, the world population has more than doubled. A scarcity mentality would suggest that such growth would lead to great shortages of goods and services, but the opposite has happened. The average person earned three times more money on an inflation-adjusted basis and ate one-third more calories of food. On average, we are now more literate and educated and less likely to die as result of war, famine, murder or childbirth.* Of course, not all of these advances are happening equally across the board. To acknowledge these improvements is not to say that all is well with the world or to turn a blind eye to real economic injustices occurring. But it is to say we should not automatically fall prey to the prevailing attitude of discontent, envy, ingratitude, and bitterness. We believe that gratitude is a source of freedom in a stifling environment of anger and discontent, and that gratitude starts with an awareness of quantifiable improvements in standards of living. The Mechanics of a Free Market Think about how the free market system actually works. You can trust an entire legion of strangers to be ethical and accountable to deliver on promises. Consider any single purchase you make. Maybe it’s a bag of coffee. Do you feel the need to open it up in the store before you buy it to make sure it’s not just filled with dirt or sawdust? When you pump gasoline into your car, how do you know you’re not being duped and filling your car with water instead? The fact is we constantly make purchases like this and take for granted all that is taking place to enable it to happen. There is a deep ecology of trust based on reciprocity. A manufacturer of goods must keep its word, or no retailer will buy from it again. If a retailer wants customers to keep coming back, it must deliver on its promises. This is increasingly true since the information explosion and prevalence of social media. A largely self-regulating web of businesses and organizations all work together rather seamlessly to meet all our needs and wants. And they deliver it all to our doorstep at the click of a button. Amazingly, there is no single master mind, dictating and directing all of the actions required. Even a seemingly insignificant item like a pencil or a shoelace involves the contributions of a vast web of people, organizations, and systems for it to be manufactured and then find its way to your front door. It’s not fashionable to defend capitalism or the free markets, but we think it’s important anyway. The reason why is because successful investing requires conviction. But in order to have the conviction needed to stick with a plan for the long run, you need to have confidence in the underlying economy. Perspective Matters Another way to say it is that behavior is a reflection of beliefs and perspectives. We believe that there are two different sets of views on the economy that comprise an investor’s perspective on the markets: • Optimism vs. Pessimism

• Skepticism vs. Trend-Following  In economic terms, optimism means you have a fundamental belief in our underlying economic system. You can have confidence in the markets over the long run because of it. Economic pessimism is the opposite of this. You lack trust and confidence in the economy and the markets and, therefore, you probably do not take comfort in long term planning and viewpoints. Skepticism refers to a cautious or sometimes contrarian point of view, which is reflected by Warren Buffett’s quote that it is best to be “greedy when others are fearful and fearful when others are greedy.” Trend-followers tend to think that “it’s different this time” and that new innovations will permanently change the game by rendering the past irrelevant. At Brown and Company, we believe in being “skeptic optimists.” That means we hold in tension two somewhat different outlooks. One on the one hand, we are optimistic about the capitalist system which gives us conviction and a long-term perspective. At the same time, we believe in reversion to the mean – or “what goes up, must come down.” Because the economy and the market move in cycles, those types of investments that have underperformed in the past will tend to outperform at some point in the future and vice versa. It’s the optimism (and lack of predictive ability to time the markets) that allows us to remain invested throughout economic cycles, but it’s the cautious skepticism that advises being proactive in preparing for a market downturn. To learn more about how to ensure that you are prepared for a recession, watch this video or read this article. * Ridley, Matt. The Rational Optimist: How Prosperity Evolves. New York: Harper Perennial; Reprint edition, 2011.

In economic terms, optimism means you have a fundamental belief in our underlying economic system. You can have confidence in the markets over the long run because of it. Economic pessimism is the opposite of this. You lack trust and confidence in the economy and the markets and, therefore, you probably do not take comfort in long term planning and viewpoints. Skepticism refers to a cautious or sometimes contrarian point of view, which is reflected by Warren Buffett’s quote that it is best to be “greedy when others are fearful and fearful when others are greedy.” Trend-followers tend to think that “it’s different this time” and that new innovations will permanently change the game by rendering the past irrelevant. At Brown and Company, we believe in being “skeptic optimists.” That means we hold in tension two somewhat different outlooks. One on the one hand, we are optimistic about the capitalist system which gives us conviction and a long-term perspective. At the same time, we believe in reversion to the mean – or “what goes up, must come down.” Because the economy and the market move in cycles, those types of investments that have underperformed in the past will tend to outperform at some point in the future and vice versa. It’s the optimism (and lack of predictive ability to time the markets) that allows us to remain invested throughout economic cycles, but it’s the cautious skepticism that advises being proactive in preparing for a market downturn. To learn more about how to ensure that you are prepared for a recession, watch this video or read this article. * Ridley, Matt. The Rational Optimist: How Prosperity Evolves. New York: Harper Perennial; Reprint edition, 2011.

Why Market Optimism Matters for Successful Investing

May 7, 2019