Latest Insights

Brown and Company Keeps You Posted

3 Estate Planning Strategies You Should Consider Now

The Big Five: What College Football Can Teach Us About the Stock Market

What Is Tax-Loss Harvesting and Why You Should Care About It?

Brown & Company In the News

Executive Compensation: Equity Compensation for Corporate Executives

Pros & Cons of Contributing to Nonqualified Deferred Compensation Plans

Thoughts on the Market and the Economy

Advanced Tax Planning Ideas – Lumping Charitable Gifts

Employee Spotlight: Meet the Team Member (Vonda Charboneau)

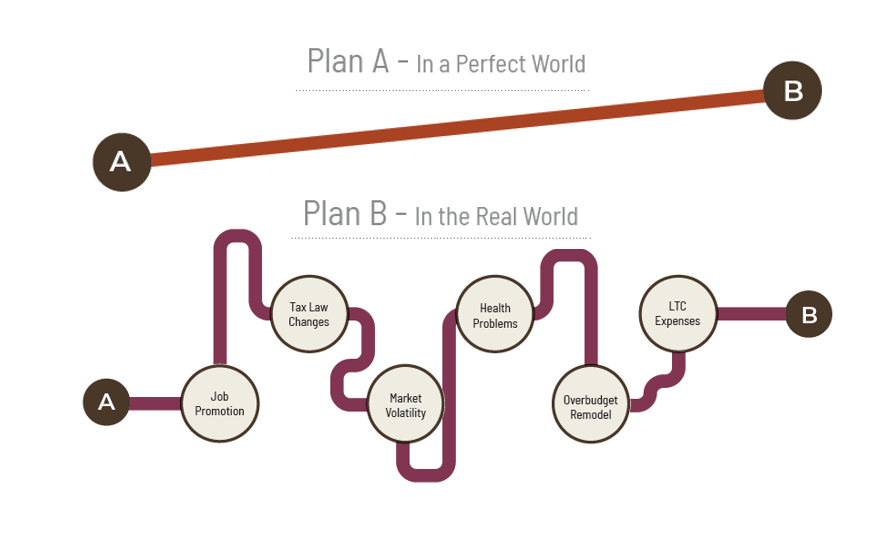

Plan B™: Retirement Planning for the Unexpected

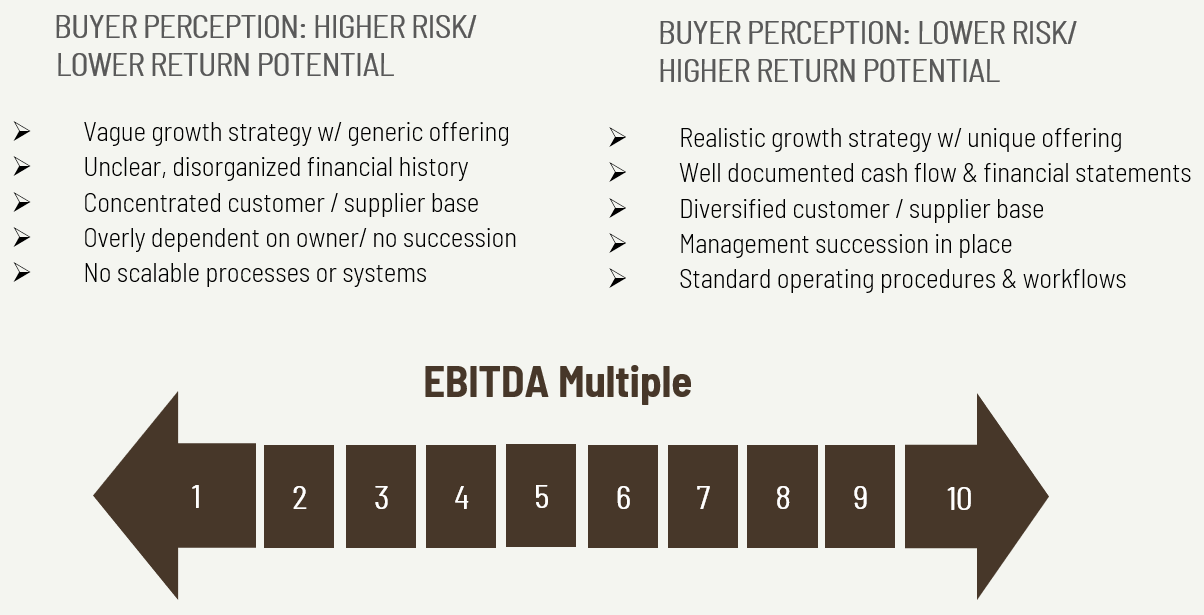

Exit Strategies for Business Owners

Market Update

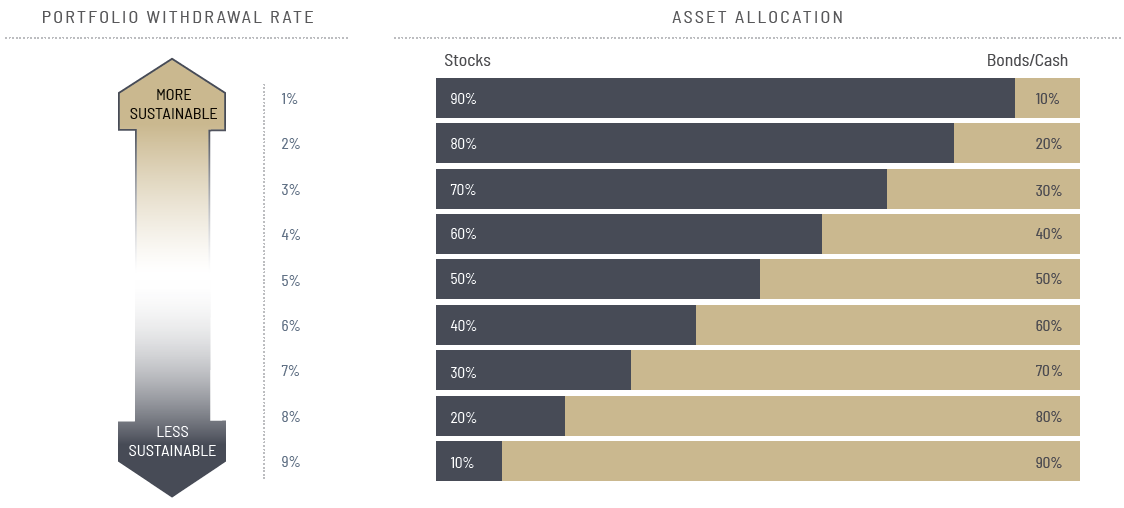

Are You Prepared for Another Market Downturn?

Retiring Business Owners – Plan for Succession

The Small Business’s Guide to Surviving the Coronavirus Pandemic

What You Need to Know About Enrolling for Medicare

Negative Oil Futures Price Creates Confusion