Latest Insights

Brown and Company Keeps You Posted

How the Stock Market Moves Ahead of the Economy

An Economy in Hibernation

How Should You Invest Cash in a Volatile Market?

The CARES Act Key Components

Market Commentary: The Good, the Bad & the Ugly

The Retirement Tax Filter

Eleven Ways to Help Yourself Stay Sane in a Crazy Market

Coronavirus – Week in Review

Sharply higher open, futures up “limit.”

Coronavirus Commentary: Thoughts Regarding the Ongoing Volatility

What is a Cash Balance Plan?

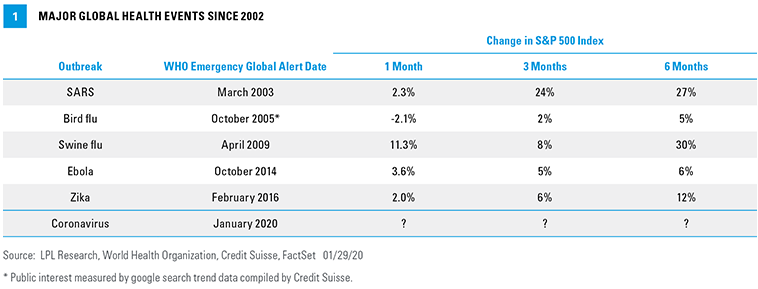

The Coronavirus & the Markets

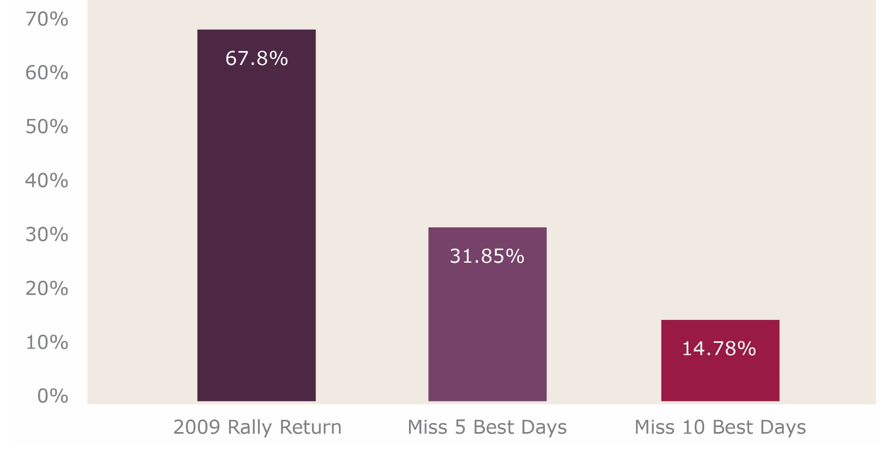

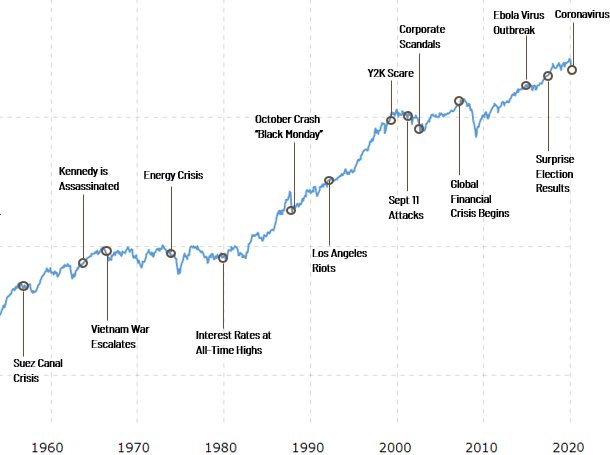

Handling Market Volatility

A Closer Look At Election Years

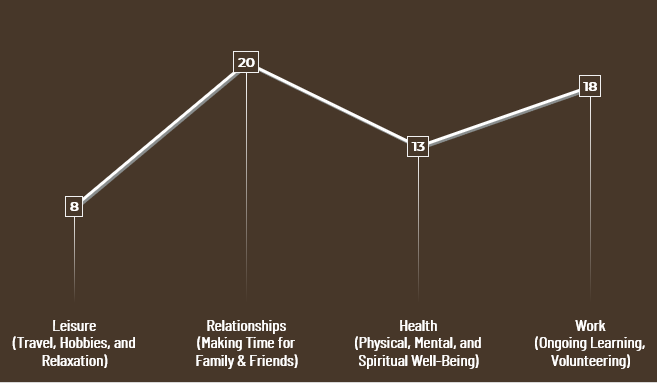

Redefining Retirement: Take Our Free Assessment

Paying the Bills: Potential Sources of Retirement Income

What Mideast Escalation Means for Markets