Latest Insights

Brown and Company Keeps You Posted

How Charitable Giving Can Benefit Donors

Top 10 Key Provisions of the SECURE Act

5 Ways to Maximize the Value of Your Business

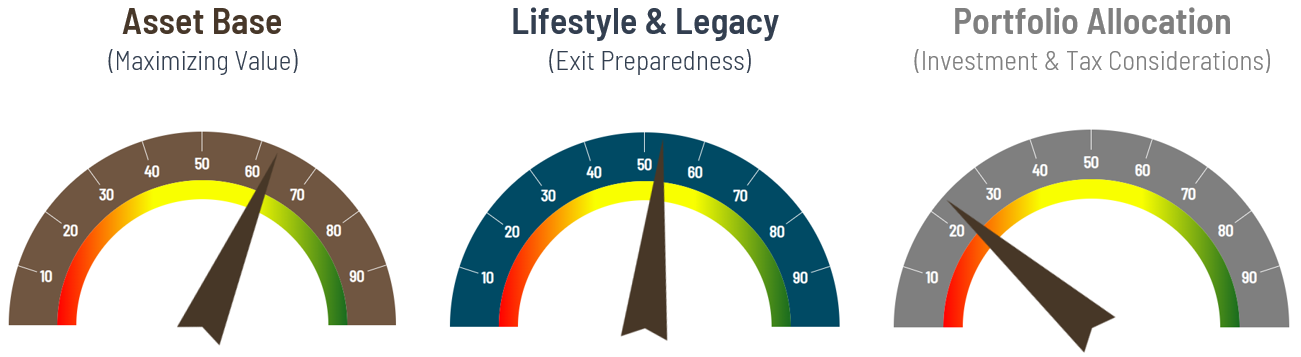

How We Provide Advice: A 150-Point Inspection

Redefining Legacy: It’s Not Just What You Leave Behind

A New Tool for Business Owners: The Buyout Barometer™

Employee Spotlight: Meet the Team Member (Danielle Berz)

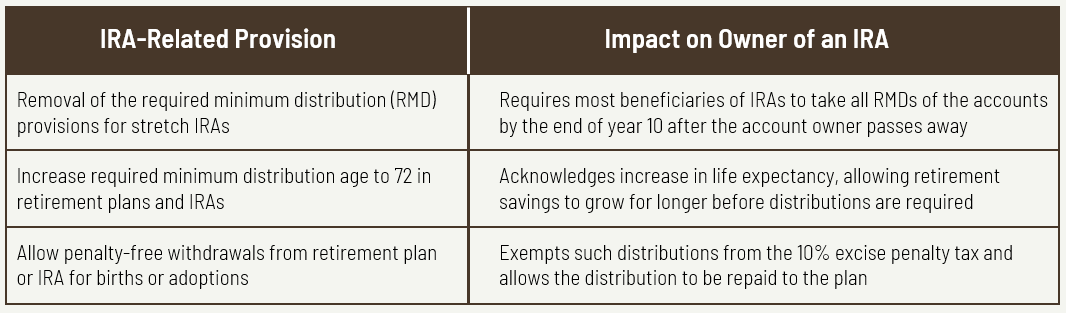

The SECURE Act Brings Big Changes to IRAs

Selling Your Business? Consider an Installment Sale

Developing an Asset Protection Plan

Employee Spotlight: Meet the Team Member (Ryan Csrnko)

Infrequently Asked Questions for Business Owners

Top 10 Year-End Planning Ideas for 2019

Employee Spotlight: Meet the Team Member (Mary Radke)

How Do You Plan for Goals That Are at Cross-Purposes?

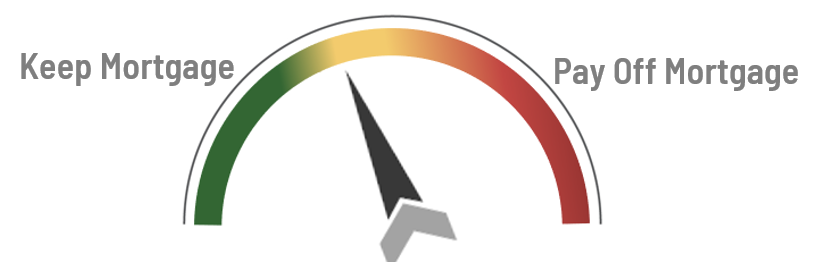

Should You Pay Off Your Mortgage?

Three Common Misconceptions About Medicare