Latest Insights

Brown and Company Keeps You Posted

A Legacy That Really Matters: Resume Virtues vs. Eulogy Virtues

Employee Spotlight: Meet the Team Member (Chad Hamilton)

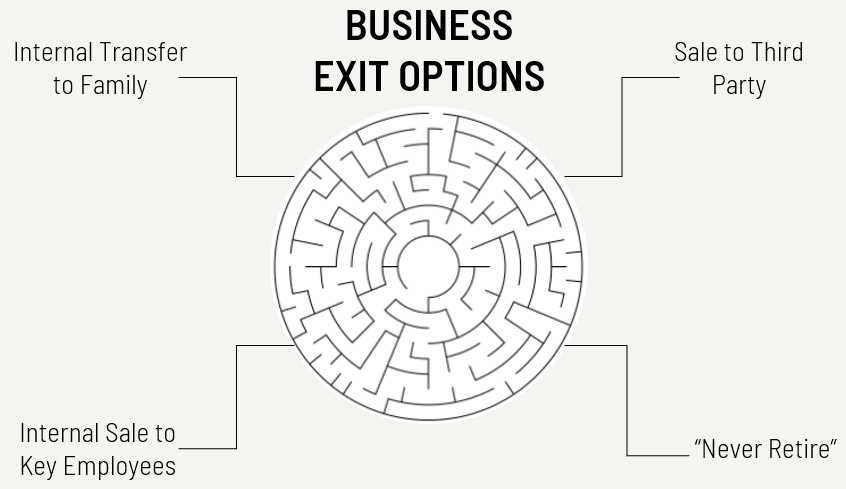

Business Transition Options: Assessing the Pros & Cons of Different Exit Strategies

Creativity Starts with Empathy

Understanding Your Withdrawal Rate: How Much Can You Afford to Spend in Retirement?

Mortgage Rates Update

How We Provide Advice: A 150-Point Inspection

401(k) Millionaires in the U.S. Reaches New High

Creating Your Retirement Paycheck (Part III) – It’s Not About Cash; It’s About Cash Flow

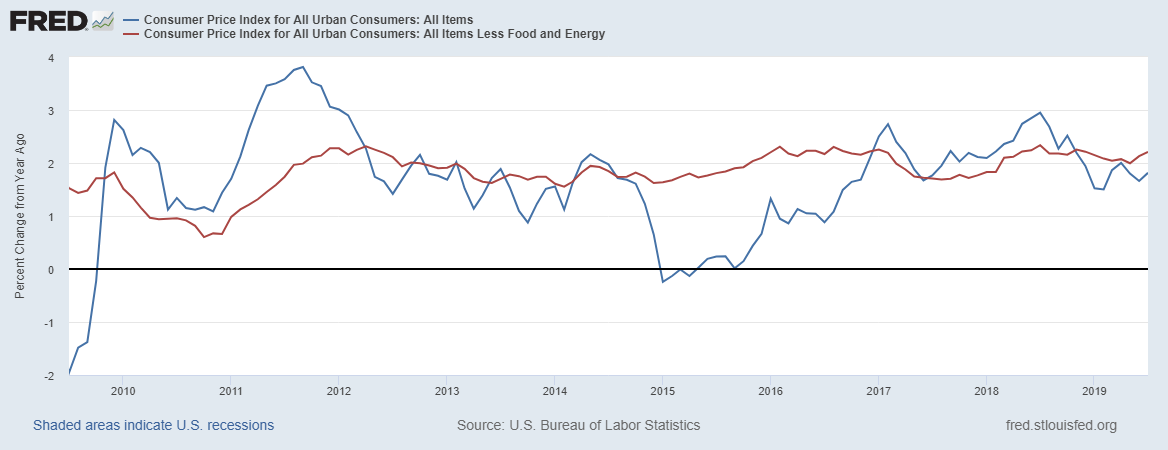

The Latest on U.S. Inflation

Global Interest Rates Turn Negative Yet Again

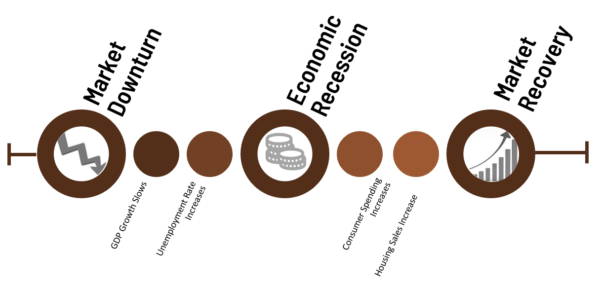

Plan B™: Retirement Planning for the Unexpected

Nothing Costs More Than Cheap Advice

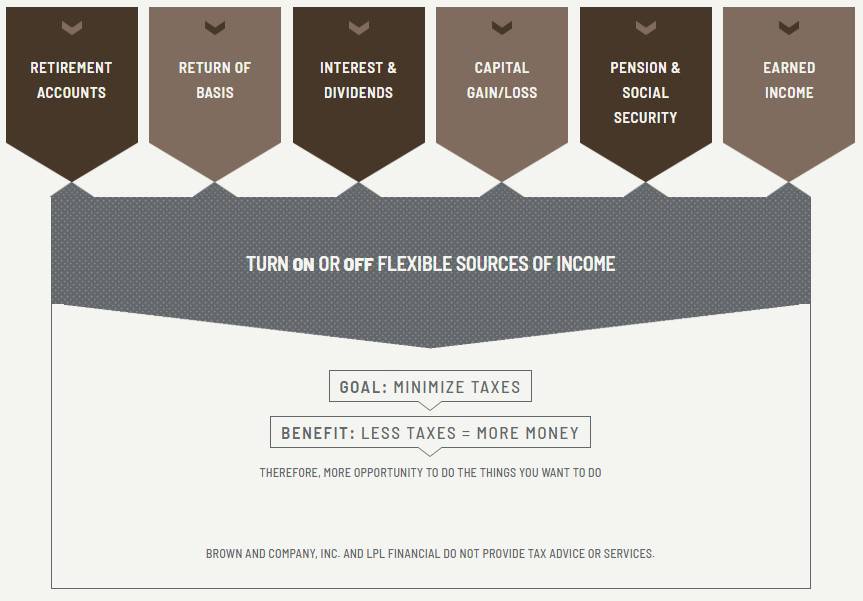

Creating Your Retirement Paycheck (Part II) – It’s Not What You Earn; It’s What You Keep

Creating Your Retirement Paycheck (Part I) – It’s Not About Returns; It’s About Your Account Balance

Socially Responsible Investing: Allianz Conference 2019

3 Types of Questions Every Financial Advisor Should Ask You