Latest Insights

Brown and Company Keeps You Posted

The Defining Characteristics of Successful Entrepreneurs

The Importance of Finding & Collaborating With a Team of Financial Professionals

It Matters How We Think About Work

Don’t “Give Money Away” (Invest in the Community)

Economic Productivity: Are We Missing a Piece of the Growth Puzzle?

Falling Interest Rates: A Bond Update

Estate Planning Questionnaire: 5 Things to Think About Before Meeting with Your Estate Attorney

Managing Income Streams for Retirement

Personal Finance Needs to Be Personalized: Why Rules of Thumb Are Misleading

The Proprietary Product Dilemma: Why Families Should Prefer Independent Advice

What Business Owners Need to Know to Successfully Transition

U.S. Economy Continues Strong Growth

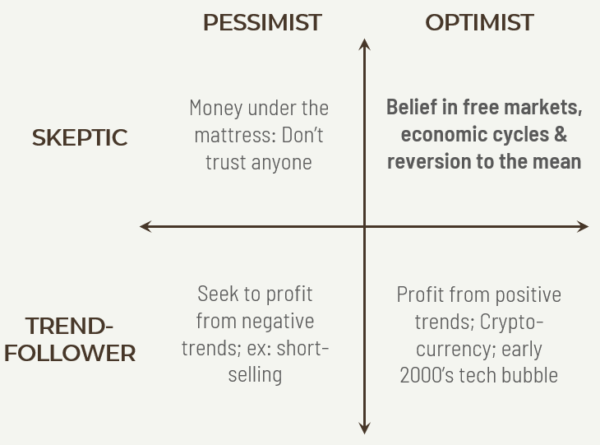

Why Market Optimism Matters for Successful Investing

How to Protect Yourself Against Unexpected Retirement

Retirement Lifestyle Questionnaire: What Does Retirement Mean to You?

Market Hits New Highs

How much are you willing to lose to achieve your goals?