Latest Insights

Brown and Company Keeps You Posted

Is It A Good Time to Invest in Energy Stocks?

Preparing for a Recession

The Leap of Faith

What Jeff Bezos and Steve Jobs Both Said 20 Years Ago

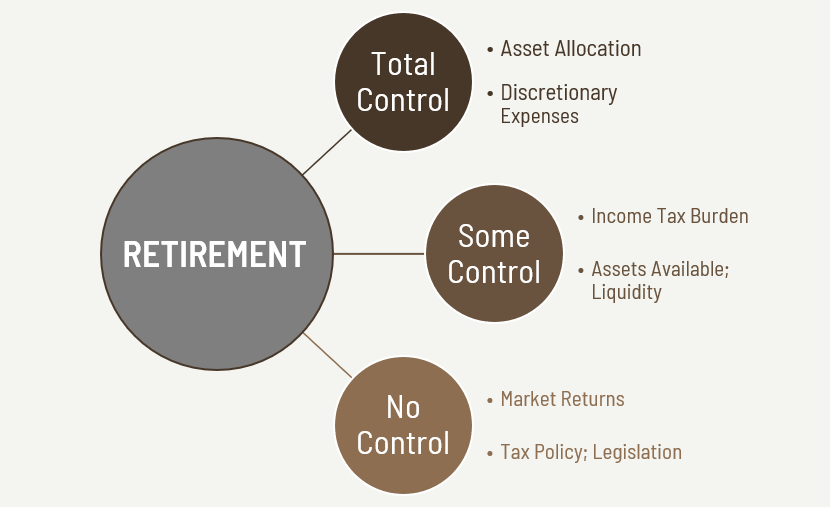

Multiple Income Streams in Retirement: Putting Together All of the Puzzle Pieces

5 Key Questions for Business Owners

Falling Interest Rates

Barron’s 2019 Conference Recap

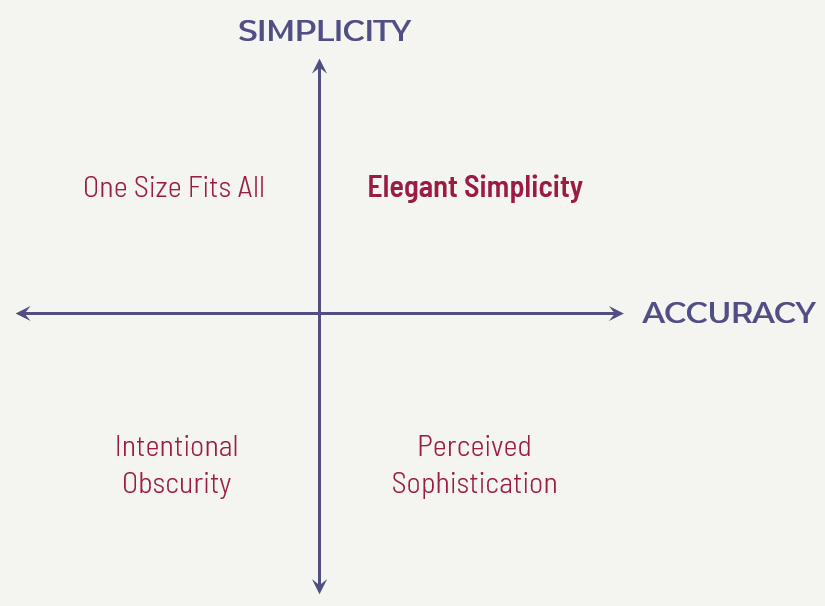

Challenges and Benefits of Simplicity

When to file for Social Security benefits?

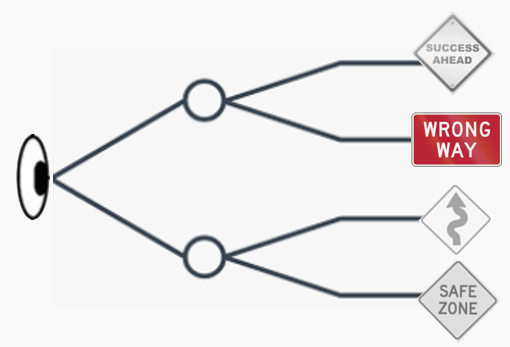

Upfront Hindsight: Anticipating Problems Before They Occur

Why Do-It-Yourselfers Become Delegators

Financial Planning for Widows: Do You Have a Plan If Your Wife Survives You?

Should You Hire a Wealth Advisor?

Are We Headed For Another Recession?

Falling Interest Rates

Putting an Extremely Volatile Market in Perspective