When you finally know where you stand, you are free to focus on other important things.

Nationally Recognized Private Wealth

It Is Not Just What We Do, But How We Do It!

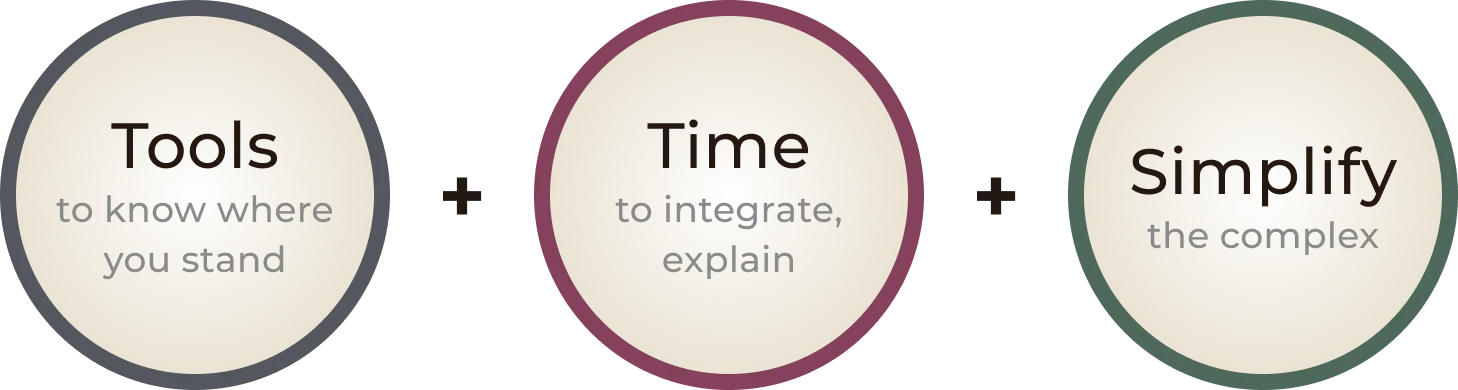

As a leading private wealth management firm, we have the proprietary tools and take the time to make sure you know where you stand and how to get to where you want to be, so that you have the clarity needed to enjoy life.