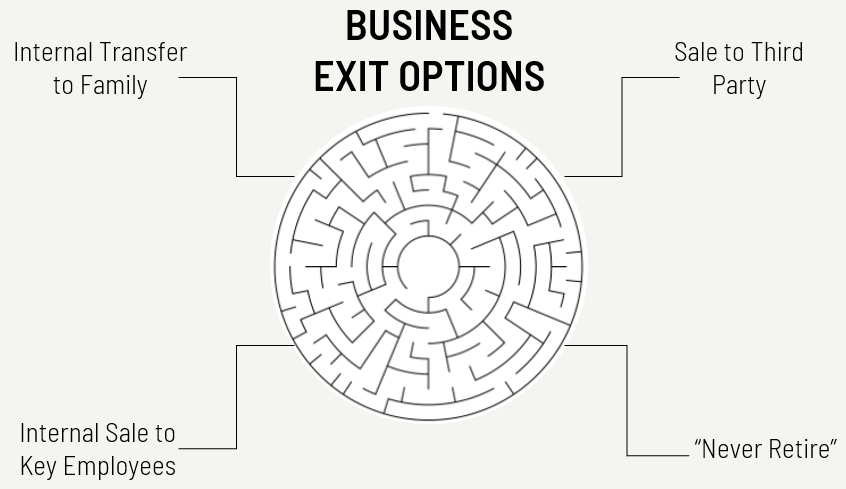

If you own a closely-held business, it is crucial to have an exit strategy worked out in advance to help ensure that you meet the personal financial and business objectives you’re hoping to achieve. Below is a visual that shows the four primary exit routes for business owners:  To understand which option is most appropriate for you, we suggest that you work through this three-step selection process. Three Steps to Choosing the Right Path Step One - First, you, as an owner and with the help of your advisors, identify your most important objectives. These objectives are both financial (“How much money will I need from the transfer of the business to assure my financial security?”) and non-financial (“I want the company to stay in the family,” or “I want to remain involved”). Internal and external considerations also impact an owner’s choice of exit path. For example, the owner who wishes to transfer the business for cash, but is unwilling to trust his company's and his employees' fate to an unknown third party, may decide that an ESOP or carefully-designed sale to a key employee group is the best exit route. External factors that may impact the choice of exit path include business, market or financial conditions. For example, the option of selling your business for cash to an outside buyer may be eliminated because of the anemic state of the M&A market. Step Two - As you develop consistent objectives and motives, you then must value your company and determine its marketability. This analysis usually provides direction and can eliminate potential exit paths. For example, if the value of a company is high and its marketability is low (perhaps because of the depressed state of the M&A market), an owner may decide that a sale of the business to an outside party is impractical. Instead, selling to an “insider” (co-owner, family member or employee) may be a better option. Step Three - The final step in choosing a path is to evaluate the tax consequences and strategies of various exit paths. Many tax-minimizing techniques require years to fully implement and are often linked to the person or entity to whom you wish to transfer the business. By utilizing these three criteria - objectives, value and tax consequences - owners can begin to narrow the list of exit routes. It is far better for you to intentionally choose the appropriate exit path than to delay and allow circumstances to force you onto a particular path. Next we will examine the potential pros and cons of each path. Option 1 - Transfer to Family Member(s) Pros:

To understand which option is most appropriate for you, we suggest that you work through this three-step selection process. Three Steps to Choosing the Right Path Step One - First, you, as an owner and with the help of your advisors, identify your most important objectives. These objectives are both financial (“How much money will I need from the transfer of the business to assure my financial security?”) and non-financial (“I want the company to stay in the family,” or “I want to remain involved”). Internal and external considerations also impact an owner’s choice of exit path. For example, the owner who wishes to transfer the business for cash, but is unwilling to trust his company's and his employees' fate to an unknown third party, may decide that an ESOP or carefully-designed sale to a key employee group is the best exit route. External factors that may impact the choice of exit path include business, market or financial conditions. For example, the option of selling your business for cash to an outside buyer may be eliminated because of the anemic state of the M&A market. Step Two - As you develop consistent objectives and motives, you then must value your company and determine its marketability. This analysis usually provides direction and can eliminate potential exit paths. For example, if the value of a company is high and its marketability is low (perhaps because of the depressed state of the M&A market), an owner may decide that a sale of the business to an outside party is impractical. Instead, selling to an “insider” (co-owner, family member or employee) may be a better option. Step Three - The final step in choosing a path is to evaluate the tax consequences and strategies of various exit paths. Many tax-minimizing techniques require years to fully implement and are often linked to the person or entity to whom you wish to transfer the business. By utilizing these three criteria - objectives, value and tax consequences - owners can begin to narrow the list of exit routes. It is far better for you to intentionally choose the appropriate exit path than to delay and allow circumstances to force you onto a particular path. Next we will examine the potential pros and cons of each path. Option 1 - Transfer to Family Member(s) Pros:

- Put the company in the hands of a known entity—specifically one’s own flesh and blood—who the owner believes will run the company as s/he did

- Provide for the well-being of the owner’s family

- Perpetuate the company’s mission or culture

- Keep the company in the community

- Allow the owner to remain involved in the company

- Without planning there is little or no cash at closing available for the owner’s retirement

- Ongoing financial risk to the owner

- Requires owner involvement in company post-closing

- Children may be unable or unwilling to assume the ownership role

- Family issues complicate treating all children fairly or equally

- Put the company in the hands of a known entity

- Perpetuate the company’s mission or culture

- Keep the company in the community

- Allow the owner to remain involved in the company

- Achieve financial security

- Without planning there is little or no cash at closing available for the owner’s retirement

- Owner experiences on-going financial risk

- Requires owner involvement in company post-closing

- Employees may be unable or unwilling to assume the ownership role

- Achieves maximum purchase price

- Usually maximizes cash at closing

- Allows owner to control date of departure

- Facilitates future company growth without owner investment or risk

- Loss of owner identity

- Loss of corporate culture and mission

- Receipt of a perhaps significant part of the purchase price subject to post-closing performance of the company

- Potentially detrimental to employees

- Maintain control

- Preserve company culture and mission

- Minimize risk (or owners perceive risk to be low)

- Maintain or even increase their cash flow with less risk of income loss

- Minimal proceeds

- Negative effect on employees/customers who want to know a long-term plan

- Continues to experience risk associated with ownership

- Never able to get away from business or embark on a significant post-business life