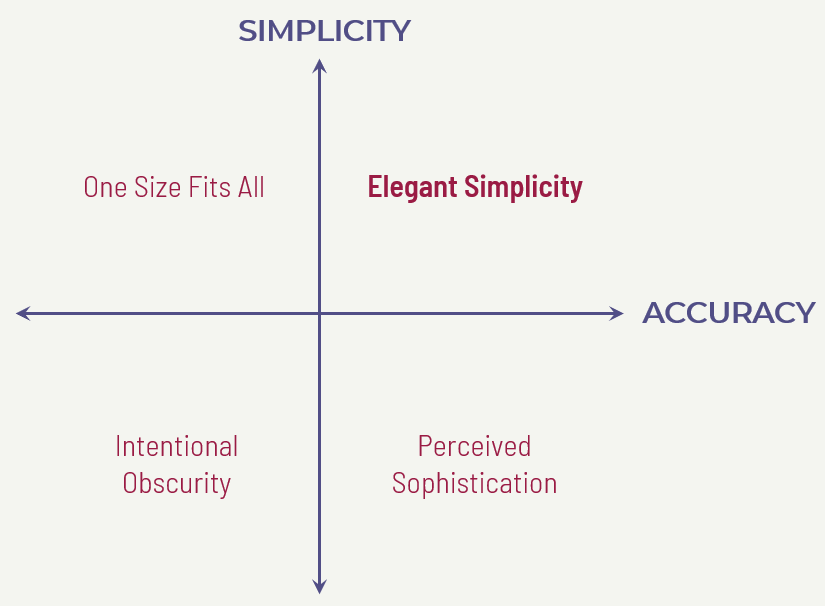

In a world of increasing complexity and unprecedented technological advancement, it is easy to feel overwhelmed. As a result, simplification can be a real gift. Ask anyone who has recently tried to research and enroll in health care benefits, and they will gladly accept an expert’s offer to simplify all of it. When done well, simplification has many benefits, ranging from the emotional to the very practical. We understand things much better when they are explained clearly and simply, and as our understanding improves, we make better decisions. We also tend to be less stressed when we are presented with important information in a less complicated way.  Yet, despite the intuitive and important benefits of simplicity, there are powerful reasons why it is so rare. The financial industry in particular has a problem with excessive complexity. Here are some reasons for this complexity epidemic. ACCURACY CAN BE LOST Einstein is believed to have said that “everything should be made as simple as possible, but not simpler.” The world is complicated, and likewise, modern finance is increasingly complex. There are financial “gurus” or how-to manuals that will offer black-and-white instructions (i.e., certain types of insurance are ALWAYS bad, certain types of investments are ALWAYS the right answer) or easy rules of thumb (i.e., spending in retirement is 80% of pre-retirement spending, etc.). This type of approach has the advantage of being simple and easy-to-remember. It can have the disadvantage of being wrong. In order to be accurate and relevant, personal finance needs to be personalized. The optimal plan for you and your family is not something that can be gleaned from seven steps in a book written for everyone. Instead, good advice is highly contingent on your stage of life, your personal goals, tolerance for risk, time horizon, cash flow needs, and so on. In short, there is a very real risk of ignoring the inherent complexities of your unique situation by having a one-size-fits-all type of plan that is too simple. COMPLEXITY MAY BE THE GOAL For some in the financial industry, complexity is not merely a by-product of what they are doing, but it is part of the end goal. The financial scandals that plagued the market in the 2000s – from Enron to Bernie Madoff – typically had one characteristic in common: intentional complexity. In these cases, the lack of transparency was a feature, not a bug. As it became harder to understand what they were actually doing, the opportunity for deception increased. There are other times when complexity is intentional, but for a less sinister reason. Less experienced wealth advisors and financial planners, in particular, can feel more confident when they have more details to present. There is comfort in providing eighty pages of data, forecasts, and statistics. The idea of presenting the essence of a retirement funding analysis and portfolio allocation recommendations in a few simplified visuals can be unnerving. Part of the value some advisors think they are providing resides in the thickness of the planning analysis and the length of the presentation. There may also be a tendency to provide recommendations in complex terms in order to display intelligence and experience. In this case, the jargon and arcane theory is presented less with the goal of educating, but instead in the hopes of sounding impressive. We convey this idea with something we call The Experience MeterTM which means that the more experience you have, the less jargon you will tend to use.

Yet, despite the intuitive and important benefits of simplicity, there are powerful reasons why it is so rare. The financial industry in particular has a problem with excessive complexity. Here are some reasons for this complexity epidemic. ACCURACY CAN BE LOST Einstein is believed to have said that “everything should be made as simple as possible, but not simpler.” The world is complicated, and likewise, modern finance is increasingly complex. There are financial “gurus” or how-to manuals that will offer black-and-white instructions (i.e., certain types of insurance are ALWAYS bad, certain types of investments are ALWAYS the right answer) or easy rules of thumb (i.e., spending in retirement is 80% of pre-retirement spending, etc.). This type of approach has the advantage of being simple and easy-to-remember. It can have the disadvantage of being wrong. In order to be accurate and relevant, personal finance needs to be personalized. The optimal plan for you and your family is not something that can be gleaned from seven steps in a book written for everyone. Instead, good advice is highly contingent on your stage of life, your personal goals, tolerance for risk, time horizon, cash flow needs, and so on. In short, there is a very real risk of ignoring the inherent complexities of your unique situation by having a one-size-fits-all type of plan that is too simple. COMPLEXITY MAY BE THE GOAL For some in the financial industry, complexity is not merely a by-product of what they are doing, but it is part of the end goal. The financial scandals that plagued the market in the 2000s – from Enron to Bernie Madoff – typically had one characteristic in common: intentional complexity. In these cases, the lack of transparency was a feature, not a bug. As it became harder to understand what they were actually doing, the opportunity for deception increased. There are other times when complexity is intentional, but for a less sinister reason. Less experienced wealth advisors and financial planners, in particular, can feel more confident when they have more details to present. There is comfort in providing eighty pages of data, forecasts, and statistics. The idea of presenting the essence of a retirement funding analysis and portfolio allocation recommendations in a few simplified visuals can be unnerving. Part of the value some advisors think they are providing resides in the thickness of the planning analysis and the length of the presentation. There may also be a tendency to provide recommendations in complex terms in order to display intelligence and experience. In this case, the jargon and arcane theory is presented less with the goal of educating, but instead in the hopes of sounding impressive. We convey this idea with something we call The Experience MeterTM which means that the more experience you have, the less jargon you will tend to use.  CONCLUSION Many of you know from personal experience how financial plans are often destined to sit on shelves gathering dust. Typically, this is the result of undue complexity, which creates output that is either too hard to understand, irrelevant, or both. At Brown and Company, we believe strongly in the value of simplicity. We ascribe to another Einstein quote: “if you can’t explain it simply, you don’t understand it well enough.” As a result, we’ve been intentional in developing visuals and tools that are designed to convey ideas in a way that is as understandable and relatable as possible. We do this because we believe that elegant simplicity is not just a stylistic preference but part of what it means to act in our clients’ best interests. Educating our clients is a key part of the role of a wealth advisor and that requires a need to communicate abstract financial concepts in a manner that is simple, practical, and actionable.

CONCLUSION Many of you know from personal experience how financial plans are often destined to sit on shelves gathering dust. Typically, this is the result of undue complexity, which creates output that is either too hard to understand, irrelevant, or both. At Brown and Company, we believe strongly in the value of simplicity. We ascribe to another Einstein quote: “if you can’t explain it simply, you don’t understand it well enough.” As a result, we’ve been intentional in developing visuals and tools that are designed to convey ideas in a way that is as understandable and relatable as possible. We do this because we believe that elegant simplicity is not just a stylistic preference but part of what it means to act in our clients’ best interests. Educating our clients is a key part of the role of a wealth advisor and that requires a need to communicate abstract financial concepts in a manner that is simple, practical, and actionable.

Challenges and Benefits of Simplicity