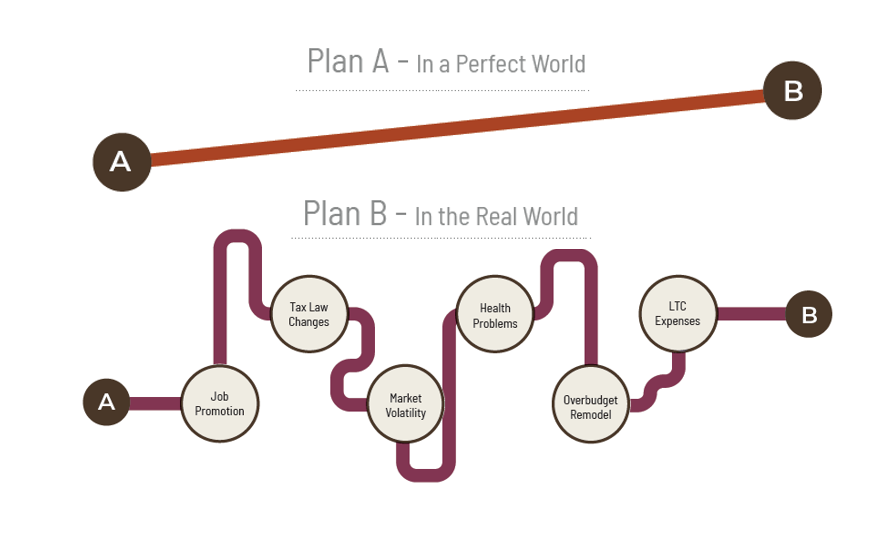

Plan B™ is an important part of Brown and Company’s personalized financial analysis and retirement consulting services, custom tailored to help you deal with the ‘What if?’ scenarios life and retirement may throw at you. The best financial planning is all centered around a simple question: “What if?” It’s all about planning for contingencies. Some of the contingencies are out of your control:

- What if legislation passes that changes the tax rates / increases regulations / alters health care laws?

- What if the inflation rate rises?

- What if the stock market has a major correction like we’re experiencing?

- What if interest rates rise?

- What if you are spending more than you can afford?

- What if you earn a lower rate of return than expected?

- What if a loved one has health problems?

- What if one spouse dies early?

- What if you lack sufficient liquidity to meet your spending needs?

- Consider a wide range of realistic possibilities (these are the problems lurking beneath the surface)

- Diagnose the implications of those possibilities

- Come up with a plan to hedge against that risk (which can mean avoiding it, insuring against it, or minimizing its impact)