For the past ten years, we’ve had a strong bull market in equities; in fact this is one of the longest bull markets in history. That doesn’t mean that it’s been all upside for the past decade. For instance, the S&P 500 Index declined by more than 10% in late January / early February of last year. But the overall trend in the markets since Spring of 2009 has been upward. There are obviously lots of advantages for investors to a strong bull market, but one potential problem is that it covers up a lot potential problems that are only exposed in a market downturn. For instance, since the upturn in stocks has been so widespread, it hasn’t mattered as much during this bull market whether you are well diversified. You also may have been able to spend more than you had planned or even saved a bit less and, due to increases in account values, you may still be in good shape. A Rising Tide There’s a common saying that “a rising tide lifts all boats,” but we should remember that those same boats all sink to varying degrees when the tide is going out. Because the economy is cyclical, we know that it is a matter of ‘when’ not ‘if’ the tide will again be lower. That doesn’t mean that we think you should try to predict the timing of the next recession; it simply means that we want to get ahead of it with proactive planning. In other words, you should review your financial plan in light of a potential downturn and consider what changes could be made to lessen the downside risk. Assessing Your Level of Control  We’ve found that one of the most helpful ways to think about your retirement security in light of negative contingencies is to organize potential changes into three categories:

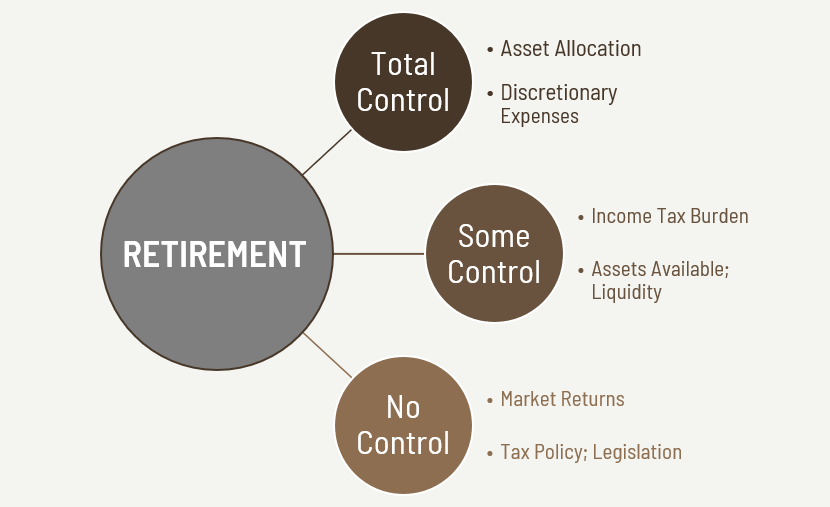

We’ve found that one of the most helpful ways to think about your retirement security in light of negative contingencies is to organize potential changes into three categories:

- Total Control – Factors like asset allocation and discretionary expenses which you can adjust

- Some Control – Things like your income tax bill or the amount of assets you have readily available which you cannot completely control, but which provide an opportunity to make some changes

- No Control – These are macroeconomic or political types of changes that can have a big impact but which you have no ability to influence

- Review stock to bond exposure – determine if you need to rebalance in order to get back to initial allocation targets and to align with your risk tolerance

- Cash flow planning – know what you are currently spending and what you plan to spend in the future

- Evaluate your balance sheet:

- Do you have debt(s) that could be paid off?

- Do you have a sufficient amount of liquidity?

- Would it make sense to turn on additional sources of income (i.e., pension, annuity, Social Security, etc.)?

- Do you have any “secret weapons” that you could use in time of need, such as a vacation property that could be sold to fund retirement needs?

- Model the impact of a market downturn – run a retirement funding analysis to determine how much (if any) surplus capital you have available to buffer a potential downturn

- Understand your portfolio yield – evaluate how a downturn might impact dividends and interest from your portfolio

- Withdrawal Stress TestTM – Designed to create an allocation that corresponds to your anticipated withdrawal rate in order to align your portfolio with your cash flow needs.

- Retirement Tax Filter® - Helps you better understand how taxes will work as you transition from earned income to passive income in retirement and proactively seek to max out the lower tax brackets without creeping into the higher tax rates.

- Retirement Shock Absorber® - This is our methodology for building a plan designed to withstand substantial market volatility without jeopardizing your financial security.