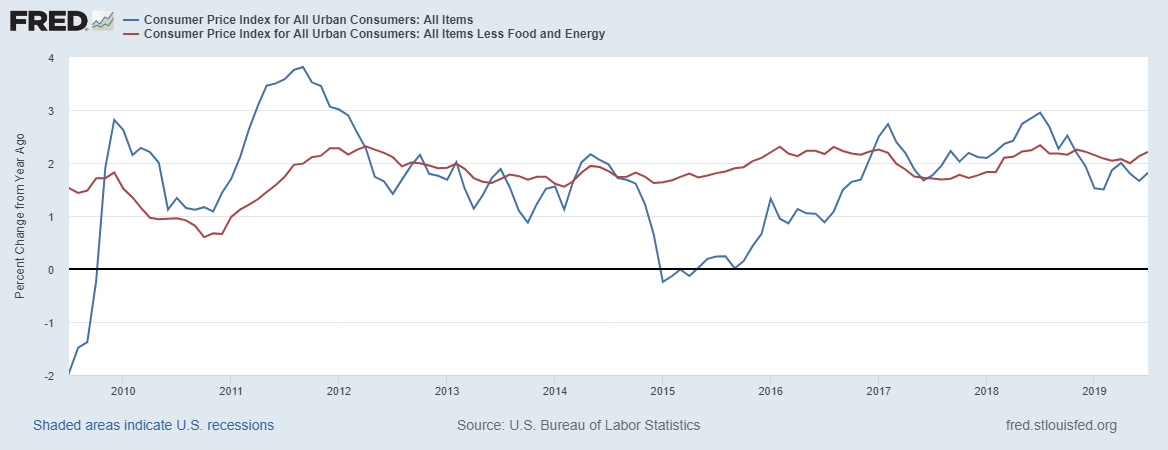

U.S. inflation remains relatively low, with the latest monthly reading of the U.S. Consumer Price Index (CPI) coming in at an annual rate of 1.8% in July. To put this number into context, since World War II the annual U.S. inflation rate has averaged above 3%.* Currently the U.S. Federal Reserve is targeting a 2%+ rate of inflation for the long-term, though the current reading is generally in-line with targets. Inflation around 2% is often viewed as a “Goldilocks” level, which is something like “not too hot” and “not too cold.” US Inflation Over the Past 10 Years  Why do the CPI reports matter? Inflation measures the purchasing power of the U.S. consumer over time. In order to measure whether U.S. consumers are generally better off, we must understand that their purchasing power is increasing—not just in nominal terms, but in real terms. By accounting for inflation, we are able to do just that. The concept of inflation is also directly related to a successful retirement and financial independence. When creating financial plans and building a solid plan for your future, we want to account for future inflation and purchasing power. By way of example, if you would like to spend $250,000 in today’s dollars in retirement in 10 years, you need to plan on spending closer to $335,000—roughly equivalent to today’s $250,000 when estimating a 3% annual inflation rate for the next decade. Low inflation makes reaching our long-term retirement goals slightly easier, as it lowers the hurdle of what our investments have to achieve. If a family’s annual investment returns are 10%, but U.S. inflation is at 5%, their real return is actually 5%. It would be the same real return if a family achieved a 7% annual return in their portfolio and U.S. inflation were at 2%: a 5% inflation-adjusted return. A byproduct of today’s global inflation picture is the current state of interest rates. The U.S. 10-Year Treasury Bond yields around 1.55% today, while some bonds in Europe and Japan have actually turned negative. Low inflation is directly related to these low bond yields. When inflation is above average, bond yields tend to rise as well. Think back to the late 1970’s and early 1980’s, when stagflation was a common factor in the U.S. economy and U.S. interest rates were above 10%. Today, we live in the opposite environment, both in the U.S. and abroad. Accordingly, prevailing interest rates are also quite low relative to history. We continue to monitor the global financial markets and their potential impact on building a robust financial plan for our clients, even accounting for low yields. While today’s low interest rate environment makes bond investing more challenging for savers and retirees, the concurrent low inflation data serve as a counter-balance. We welcome the opportunity to speak with you at greater length about your plan, in light of these latest trends in inflation and bond yields. *U.S. Bureau of Labor Statistics. Online. https://tradingeconomics.com/united-states/inflation-cpi

Why do the CPI reports matter? Inflation measures the purchasing power of the U.S. consumer over time. In order to measure whether U.S. consumers are generally better off, we must understand that their purchasing power is increasing—not just in nominal terms, but in real terms. By accounting for inflation, we are able to do just that. The concept of inflation is also directly related to a successful retirement and financial independence. When creating financial plans and building a solid plan for your future, we want to account for future inflation and purchasing power. By way of example, if you would like to spend $250,000 in today’s dollars in retirement in 10 years, you need to plan on spending closer to $335,000—roughly equivalent to today’s $250,000 when estimating a 3% annual inflation rate for the next decade. Low inflation makes reaching our long-term retirement goals slightly easier, as it lowers the hurdle of what our investments have to achieve. If a family’s annual investment returns are 10%, but U.S. inflation is at 5%, their real return is actually 5%. It would be the same real return if a family achieved a 7% annual return in their portfolio and U.S. inflation were at 2%: a 5% inflation-adjusted return. A byproduct of today’s global inflation picture is the current state of interest rates. The U.S. 10-Year Treasury Bond yields around 1.55% today, while some bonds in Europe and Japan have actually turned negative. Low inflation is directly related to these low bond yields. When inflation is above average, bond yields tend to rise as well. Think back to the late 1970’s and early 1980’s, when stagflation was a common factor in the U.S. economy and U.S. interest rates were above 10%. Today, we live in the opposite environment, both in the U.S. and abroad. Accordingly, prevailing interest rates are also quite low relative to history. We continue to monitor the global financial markets and their potential impact on building a robust financial plan for our clients, even accounting for low yields. While today’s low interest rate environment makes bond investing more challenging for savers and retirees, the concurrent low inflation data serve as a counter-balance. We welcome the opportunity to speak with you at greater length about your plan, in light of these latest trends in inflation and bond yields. *U.S. Bureau of Labor Statistics. Online. https://tradingeconomics.com/united-states/inflation-cpi

The Latest on U.S. Inflation