Today's low interest rates are a far cry from the double-digit rates seen in the 1970s and 1980s when even a certificate of deposit (CD) could yield up to 20 percent per year.1 But there are some distinct advantages to a low-interest-rate environment, and now is a great time to look into some tax-saving estate planning strategies. Learn more about how intra-family loans, charitable trusts, and certain installment sales can help you transfer assets while helping reduce your tax liability.

Charitable Trusts

A charitable lead annuity trust (CLAT) is a trust that distributes annuity payments to a charity of the settler's choice. The amount of the annuity payment will be fixed on the date the CLAT is established. If the trust assets are invested in such a way that they beat the benchmark returns, any remainder will go to the stated beneficiary, free from any gift tax. These trusts allow the donor to reduce the size of their estate, potentially avoiding estate and gift taxes, while providing a regular source of income to a worthy cause. CLATs can be designed to benefit just one charity or multiple charities, and the remaining amount can be bequeathed to a charity, a relative, or just about anyone else.Intra-family Cash Loans

If you're planning to distribute assets to certain people in your life, a low-interest-rate environment can provide a prime opportunity to provide intra-family loans. Essentially, you'll loan a large lump sum to a family member to be invested in another asset (like stocks, bonds, real estate, or other securities). If these investments increase in value, any "spread" between this rate of return and the loan's interest rate can be paid to the borrower—all without gift tax. In other words, this loan allows the recipient to earn gift-tax-free income on borrowed principal, then simply cash out this principal and repay the loan once the term has ended. Depending on how interest rates rise or fall over the term of the loan, these loans can often be extended to provide even more benefits. To make an intra-family cash loan, you and the recipient will need to execute a promissory note that requires the recipient to make interest-only payments for a certain number of years, then a balloon payment when the loan matures. The interest payments on this loan are generally deductible by the recipient and taxable to you.Installment Sale

Much like an inter-family loan, an installment sale to an intentionally defective grantor trust (IDGT) allows the borrower (the trust) to gain the income from the appreciating asset. And unlike an intra-family loan, the trust assets aren't assessed income taxes as they grow, allowing the trust principal to increase in value without incurring any extra tax liability. This method will require the grantor to create and fund a trust, a far more complicated transaction than executing a promissory note for an intra-family loan. However, this method has some unique tax-saving benefits that can allow you to pass on income-generating assets to your loved ones while helping reduce your tax burden.Conclusion

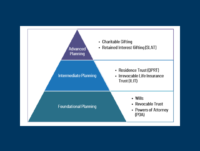

Estate planning should be a comprehensive and ongoing process that is centered around your family’s goals. The strategies mentioned here can make sense from an advanced tax planning standpoint, but it’s always important to consider these as an extension of more foundational planning. Take a look at this article to make sure you have all of your key estate planning documents in place as well. Important Disclosures: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal advisor. LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. Sources

1 https://www.businessinsider.com/every-interest-rate-cycle-since-1970s-2015-12#late-december-1986-to-early-june-1989-9 https://www.jpmorgan.com/securities/insights/wf-estate-planning-in-a-low-interest-rate-environment