This is the second in a three-part series of articles designed to help you better understand how to create a paycheck in retirement. (CLICK HERE to read the first one.) To answer that question, we're addressing the following three topics:

- It's not about returns; it's about your account balance

- It's not how much you earn; it's how much you keep

- It's not about cash; it's about cash flow

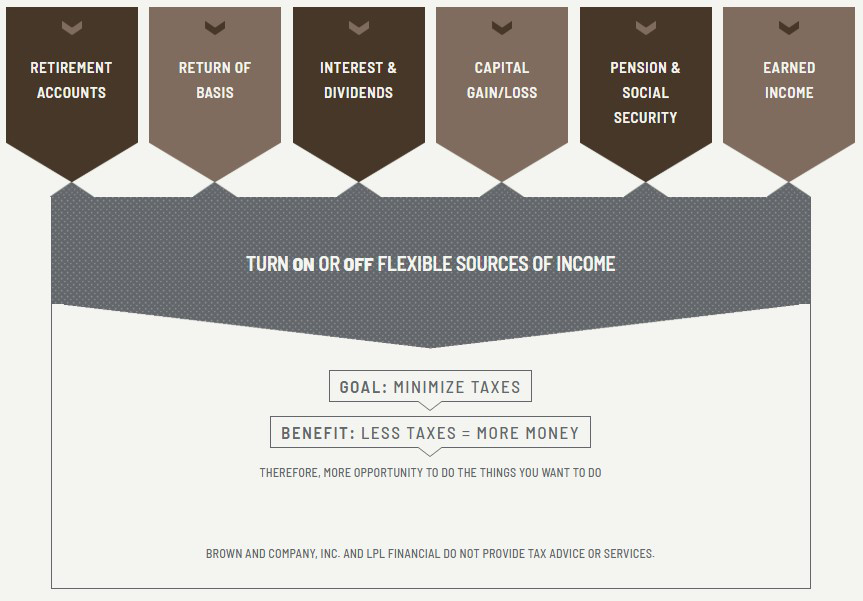

We consider your various sources of income: retirement accounts, return of basis, interest and dividends, capital gain and loss, pension and Social Security, and earned income. These are different pools of money each with their own type of tax treatment. The Retirement Tax Filter® helps you see how to strategically pull from each of the various pools to create the most tax-efficient income. These concepts might sound complicated, but the tool is extremely intuitive. You can turn on and off the different buckets of money and also increase or decrease the amounts of income being generated. For instance, withdrawals from retirement accounts funded with pre-tax dollars are also subject to ordinary income tax, but they can be delayed until 70-1/2 if you have other available income sources. You may choose to incorporate tax-free sources of income including withdrawals from Roth IRAs, municipal bond interest, or return of basis from investments that have already been taxed. Interest, dividends, or capital gains create their own forms of tax treatment, which are generally lower than ordinary income tax rates. Social Security benefits can be taken early, at age 62, delayed until age 70, or taken anytime in between, and some pension plans let you determine when to take your benefits. Our tool allows you to clearly see and understand the estimated tax impact of each decision. We work closely with our clients’ CPAs to implement the best tax planning strategies over many years. Jargon-Free Approach We have always been amazed by the ridiculous complexity of the investment industry. Financial jargon, confusing acronyms and “back-stage” jargon are commonplace across the wealth management space. Our approach at Brown & Co. is truly the opposite. We bring clarity and simplicity to complicated subjects. The Retirement Tax Filter® is one of the ways in which we do that. Securities offered through LPL Financial, Member FINRA/SIPC. Financial planning offered through Brown and Co., Inc, a Registered Investment Advisor and separate entity. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.