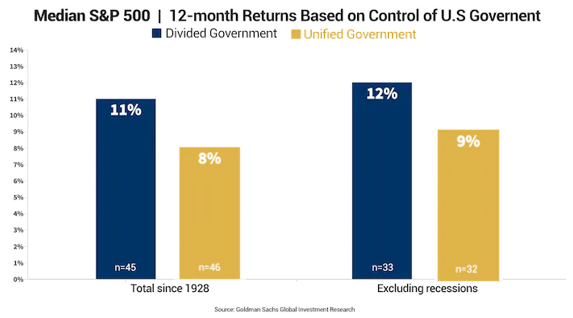

In the month leading up to the election, we held our Fall Lecture Series of webinars (click here to watch the replays). Now, we want to provide our commentary on what has transpired since Election Day and consider how that might impact the markets going forward. Here are some thoughts about what the election results mean from the perspective of the markets, but first let's consider what the election results do not mean. What the Results Don't Mean This was a much closer election than most of the polls had projected. In the middle of a deadly pandemic and significant unemployment, the presidential election came down to a few thousand votes in several swing states. Since this was not the landslide that many had expected, it was not a mandate for the far left. There was enough vote-splitting that we will likely end up with a Democratic President, a Republican Senate, and a narrower Democratic majority in the House of Representatives. From a policy perspective, that is important because it means that Biden will need to work with the opposition party in the Senate to get anything done. It is much less likely that Biden will feel pressured to move further left, which was more conceivable in a blue wave scenario. What the Results Do Mean Leading up to the election, Wall Street had been preparing for a Democratic-controlled government that would likely raise corporate taxes and increase regulations of major industries, which the markets feared would reduce corporate earnings. If Republicans maintain control of the Senate, they are expected to block those efforts. Historically, as you can see in the chart above, the stock market has performed better during periods of a divided federal government than it has when one political party has controlled the White House, Senate, and House of Representatives. What the Market Cares Most About Although the election gets the most attention, the market is more concerned with COVID-19 and its impact on the economy. On Monday morning, we received some of the best COVID news since the onset of the pandemic, and that sent stocks surging with the hope that the end of the pandemic is at least in sight. Pfizer announced that its vaccine is more than 90% effective in preventing the disease, and that it plans to ask the FDA for an emergency authorization later this month. The 90% effectiveness far surpasses the 70% effective rate that some experts had expected. Several leading vaccine developers had been moving swiftly through Phase III trials over the last few months so the news was not a total surprise. According to estimates from the White House's vaccine development program, Operation Warp Speed, the U.S. may be on track for modest doses of the vaccine by the end of the year, and a full rollout in early 2021.

Post-Election Commentary: Impact on the Markets