As a wealth management firm, our objective is to not only help clients reach their goals, but also define those goals as well. For instance, if one of your goals is to retire at age 62, we could not help you actually achieve that goal unless we know what “retirement” means to you. Often that means redefining retirement. The Changing Nature of Retirement The word retirement was popularized in the United States in the 1930’s when President Roosevelt was instituting the Social Security system. The retirement age for Social Security benefits was 65 and, at that time, the average life expectancy was 62. So, if you were in the fortunate minority that lived to see retirement, it was typically not more than a year or two. Think of how different it is today. A 65-year-old couple has about a 50% chance that at least one of them will live to age 90. Now, with quite a number of people retiring before 65, it is certainly reasonable to plan on 30 or more years in retirement. But aside from the big changes in life expectancy over the last 80 years, there is good reason to believe we’ve outgrown the term. One hundred years ago, the average worker was engaged in manual labor, often in factories or manufacturing plants. Workers functioned like machinery and, as such, a 65-year-old could not compete with the productivity of a 25-year-old. That’s what the author Stephen R. Covey meant when he said, "To me, the whole concept of retirement is a flawed notion, a culturally misaligned relic of the Industrial Age." Mitch Anthony, author of The New Retirementality, put it this way: "We have been hanging onto that concept, but it no longer makes sense because most of us no longer trade our physical capacity for a paycheck. We trade our intellectual capacity and our relational capacity for a paycheck." Redefining Retirement The traditional notion of retirement means to withdraw and that’s a poor premise for entering a new phase of life. It’s a negative emotion, and no creative thought develops out of a negative impulse. Yet, that is exactly what the first definition of retirement is all about: what life is not like. It does not provide a positive vision. What we need to do is redefine for ourselves what retirement really means. It’s about asking what you are going to retire to rather than retire from. Think in terms of a vision for a whole new phase of life. What kinds of things will you be doing? How will you spend your time? For some of people, redefining retirement means launching an entirely new career; others are using their existing skills and applying them to entirely new causes. Still others are using their entrepreneurial skills to create new socially-minded businesses or engage in philanthropy with your family. Regardless of the specific form it takes, the best retirement typically involves some ideal balance between work, leisure, family, and community. A successful retirement will fully engage our core strengths and passions. It’s got to be driven by your purpose and values. Here's a short video that explains it:

Redefining Retirement: Take Our Free Assessment

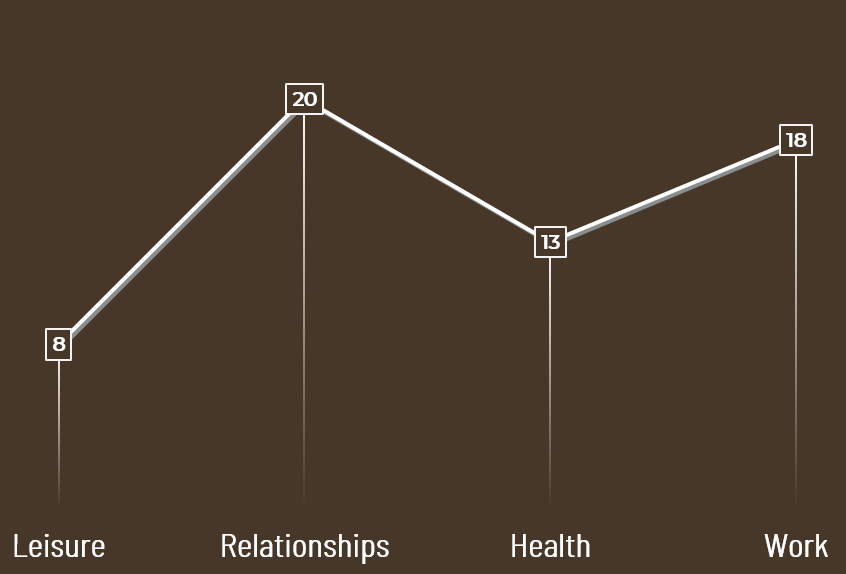

Take a Free Assessment We’ve created a free online tool that allows you to do that. If you take five minutes to complete an assessment, you'll get a one-page report that helps you start to clarify what retirement means to you. Our assessment is comprised of just eight questions. The first six questions each ask you to prioritize four statements based on what’s most appealing to you. Then, the last two questions ask you to think about someone you know who has recently retired and consider both positive and negative things you’ve observed. First, identify from our list the things you want to avoid in your own retirement (i.e., boredom, marital strain, lack of challenges, etc.) Second, you are asked to identify things you would like to experience in your own retirement (i.e., fulfilling hobbies, physical activities, etc.) Go ahead and try it for yourself - just click on this link and take our retirement vision assessment to get started today.