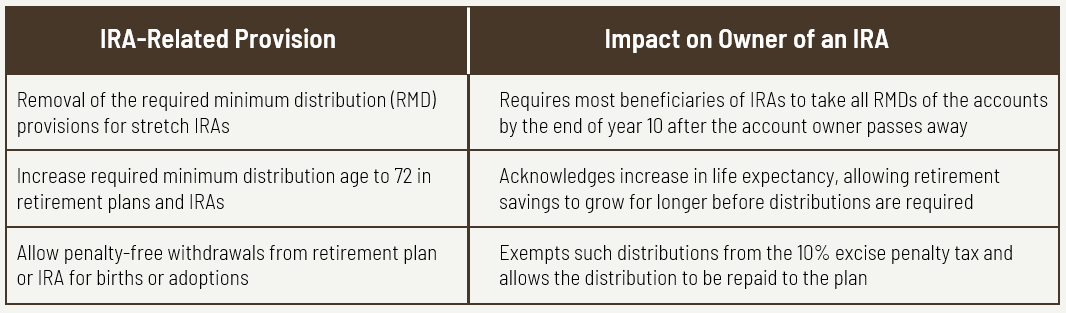

To avert another government shutdown, Congress just agreed on a new spending bill. There’s been extensive news coverage of the spending bill, but a lesser known aspect of it is a piece of legislation called the Setting Every Community Up for Retirement Enhancement (SECURE) Act. The SECURE Act is one of the most significant retirement reforms in years and brings big changes to Individual Retirement Accounts (IRAs). Required Minimum Distributions In order to incentivize individuals to save for retirement, the tax code offers tax-deferred growth for assets held within IRAs and qualified retirement plans. Particularly for those who have excess wealth that they intend to pass on to heirs, IRAs have historically been a good type of account to pass on to beneficiaries. Required Minimum Distributions (RMDs) have been a way for the IRS to ensure that these retirement assets did not grow in perpetuity, but instead that taxes would ultimately be paid. Delaying the Start of RMDs Up until now, the law has said you have to take your first RMD in the year you turn 70½, although you have the option to delay until April 1 of the following year. In all subsequent years, you must take the required amount by the end of the calendar year. The SECURE Act, if the President signs it into law as he is widely expected to do, contains a provision that will increase the age for beginning RMDs from 70 ½ to 72. This change is an acknowledgement of the increase in life expectancy which allows for savings to grow a bit longer before requiring distributions to commence. The End of Stretch IRAs Just like it sounds, an “Inherited IRA” is an IRA that is inherited by a non-spousal beneficiary. If the owner of an inherited IRA was a designated beneficiary, (s)he was typically able to spread the distributions over his or her own life expectancy. This was commonly referred to as a “Stretch IRA” and the SECURE Act has eliminated this provision. Instead, all distributions must typically be completed within a 10-year period after the IRA owner has died. No longer will certain “inherited IRAs” be able to be distributed over the lifetime of a beneficiary. This change can make a significant impact for those who have a large amount of assets in qualified retirement plans or IRAs and plan to pass on much of those assets to beneficiaries. Additional Access to Funds for New Parents Previously, you were only allowed to take withdrawals from a 401(k) plan before the age of 59 ½ if you had “hardships” or if you were a first-time homebuyer or funding qualified educational expenses. The SECURE Act permits IRA and 401(k) account holders under the age of 59 ½ to withdrawal up to $5,000 penalty-free to pay for expenses related to a new baby or an adoption. For two spouses who each have a retirement account, this would mean as much as $10,000 that could be used ($5,000 from each of their own IRAs or 401(k)s). The SECURE Act contains other changes beyond the scope of what we covered here including an increase in the ability to use annuities inside of company retirement plans. Conclusion From our point of view, the SECURE Act is a bit of a mixed bag. Some of these changes will provide more flexibility for planning purposes and life circumstances, but others may adversely affect estate and tax planning. We believe that these types of changes need to be taken into account as part of a larger and more comprehensive plan. When deciding the timing and amount of income you will withdraw from IRAs, you should consider all other sources of income as well. Watch our Retirement Tax Filter video below for an overview of how to think more broadly about tax-sensitive income planning in retirement. https://www.youtube.com/watch?v=rkEu29A_gKg&t=13s

The SECURE Act Brings Big Changes to IRAs