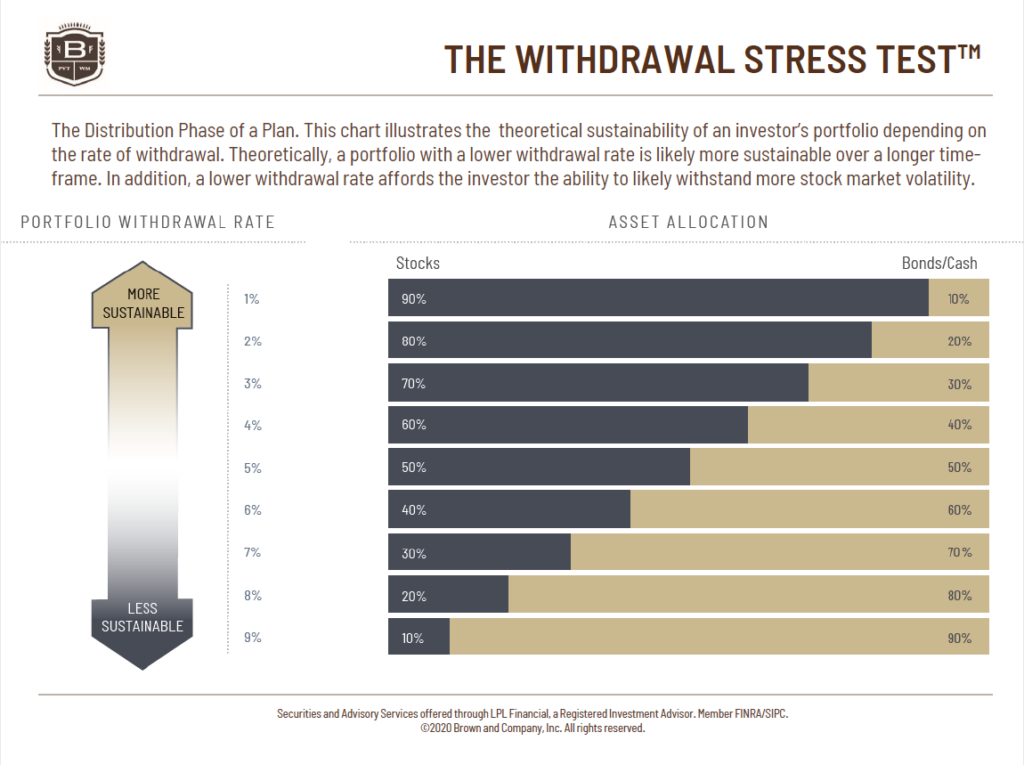

Our Withdrawal Stress Test™ is a valuable tool that assesses the sustainability of your portfolio throughout your retirement and lifespan. The basic principle is that a lower withdrawal rate enhances your portfolio’s long-term sustainability. When coupled with our private wealth management services, this tool aids in determining the optimal asset allocation for your portfolio based on your expected future withdrawals.

Calculating your withdrawal rate involves dividing your total annual withdrawals by your portfolio value. The lower the withdrawal rate, the more flexibility your portfolio has in terms of allocation and risk.

Setting emotions aside, let’s consider an example: If you’re withdrawing only 1% of your portfolio annually, you can choose to take on more equity risk for potential higher growth, or opt for lower risk with a corresponding lower return potential. For many, a typical withdrawal rate falls in the range of 3% to 4%, equivalent to $30,000 to $40,000 per $1,000,000 annually.

However, it’s crucial to factor in inflation, as the cost of living tends to double every 20 years. Some portion of returns is assumed to be reinvested to keep pace with inflation. Consider your first new car — comparing its cost then versus today’s cost provides a clear illustration of the impact of inflation on expenses.

At Brown and Company, we’re not just focused on building wealth; we’re dedicated to helping you navigate the complexities of withdrawing money in retirement. Our Withdrawal Stress Test™ is a tool designed to guide you towards optimal asset allocation, ensuring your portfolio will sustain your needs throughout your retirement journey.