Latest Insights

Brown and Company Keeps You Posted

Falling Interest Rates: A Bond Update

Medium and long-term interest rates in the U.S. have fallen precipitously in the past month. Indeed, the yield on the 10 Year U.S. Treasury Bond has fallen from over 2.55% in early May to just above 2.07% today. A confluence of factors are at least partially responsible for falling interest rates: increasing trade tensions with ... Falling Interest Rates: A Bond Update

Estate Planning Questionnaire: 5 Things to Think About Before Meeting with Your Estate Attorney

Estate documents should be reviewed regularly to ensure that they are up-to-date and still adequately express your wishes pertaining to the distribution of your estate. Changes in your personal, family, or business circumstances along with changes in tax laws can necessitate the need for updates. At a minimum, beneficiary designations on retirement accounts and life ... Estate Planning Questionnaire: 5 Things to Think About Before Meeting with Your Estate Attorney

Managing Income Streams for Retirement

When approaching retirement, many families focus on their ability to reach financial independence based solely upon their investment holdings and savings. While their investments are, of course, an important part of their overall financial picture, they are not the only factor in the retirement equation. What families often miss is the contribution of the various ... Managing Income Streams for Retirement

Personal Finance Needs to Be Personalized: Why Rules of Thumb Are Misleading

If you are trying to figure out how much you need to save for retirement or determine how much life insurance you should have, financial rules of thumb can be a helpful starting point. But as your situation becomes more complex and your level of wealth grows, rules of thumb can go from being helpful ... Personal Finance Needs to Be Personalized: Why Rules of Thumb Are Misleading

The Proprietary Product Dilemma: Why Families Should Prefer Independent Advice

For high net worth families, one of the many pitfalls that is not often discussed when hiring and evaluating a wealth advisor is the use of “proprietary products” in their investment portfolio. The use of proprietary mutual funds is very common in the investment industry. Here is how it works: a family hires a bank ... The Proprietary Product Dilemma: Why Families Should Prefer Independent Advice

What Business Owners Need to Know to Successfully Transition

According to a survey from PriceWaterHouseCoopers, 3 out of 4 business owners surveyed said they “profoundly regretted” selling their company. Watch this 2-minute video to learn about how we work with business owners to prepare for transition into retirement. You can also read our case study to get more details on our process. GET A SECOND ... What Business Owners Need to Know to Successfully Transition

U.S. Economy Continues Strong Growth

The U.S. economy grew by an annualized rate of 3.2% in the first quarter of 2019, according to the Bureau of Economic Analysis in late April. The growth was surprisingly strong, as the consensus estimate of Dow Jones-polled economists had estimated a Q1 growth rate of 2.5%. The reading from the first quarter inspired confidence, ... U.S. Economy Continues Strong Growth

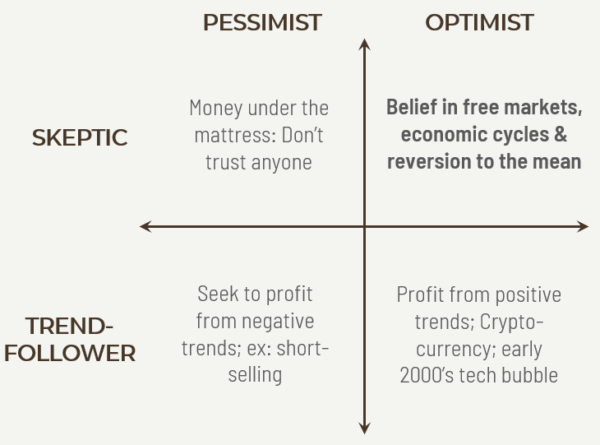

Why Market Optimism Matters for Successful Investing

It’s pretty easy to succumb to cynicism and pessimism in the current environment. Nearly 60% of people believe the U.S. is on the wrong track. Trust in institutions is at or near all-time lows. Scandals, natural disasters, and mass violence are all too prevalent. If you start to extrapolate that out into the future, your ... Why Market Optimism Matters for Successful Investing

How to Protect Yourself Against Unexpected Retirement

The Boston College Center for Retirement Research published a recent report on retirement age and the factors that contribute to people retiring early. The results were not surprising, although there were some interesting takeaways from the research, especially regarding unexpected retirement.[1] The report on retiring early comes from other economic research, which suggests that many ... How to Protect Yourself Against Unexpected Retirement

Retirement Lifestyle Questionnaire: What Does Retirement Mean to You?

Husbands and wives are often out-of-sync when it comes to retirement because of differing views of how they’d like to spend their time. These differences are not necessarily a problem if you become aware of them ahead of time. To help you get started with this process of envisioning a meaningful retirement, we recommend thinking ... Retirement Lifestyle Questionnaire: What Does Retirement Mean to You?

Market Hits New Highs

The S&P 500 Index and the Nasdaq Composite closed at all time highs on April 23rd, marking a significant turnaround from the U.S. stock market’s decline at the end of 2018. The S&P 500 Index closed the day at 2,933.68 and the Nasdaq at 8,120.82. For the year, the S&P 500 Index is now up ... Market Hits New Highs

How much are you willing to lose to achieve your goals?

Academic theory of the financial world is often built upon one main assumption: that people are perfectly rational in making economic decisions and that these rational decisions by individuals help to create a high degree of efficiency in the broader financial markets. Efficient markets work, as the theory goes, because all actors are behaving in ... How much are you willing to lose to achieve your goals?