Latest Insights

Brown and Company Keeps You Posted

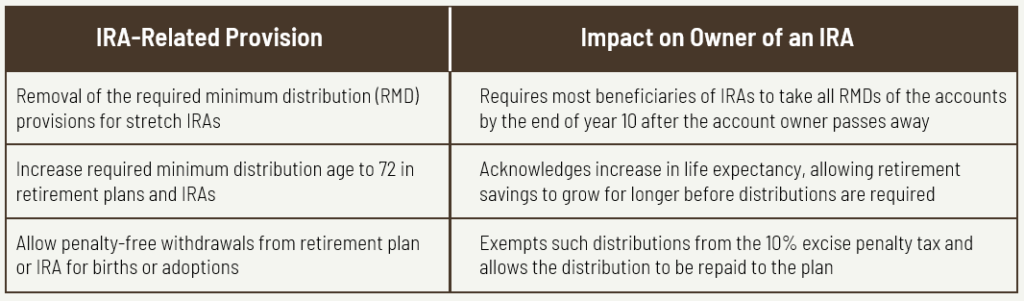

The SECURE Act Brings Big Changes to IRAs

To avert another government shutdown, Congress just agreed on a new spending bill. There’s been extensive news coverage of the spending bill, but a lesser known aspect of it is a piece of legislation called the Setting Every Community Up for Retirement Enhancement (SECURE) Act. The SECURE Act is one of the most significant retirement ... The SECURE Act Brings Big Changes to IRAs

Selling Your Business? Consider an Installment Sale

We’ve talked about different ways to transition a business, but now we want to consider how you can structure the sale of a business. An installment sale is a transaction in which you sell your business to another party and the purchase price is spread over two or more years. To qualify for installment sales ... Selling Your Business? Consider an Installment Sale

Developing an Asset Protection Plan

On average, a new lawsuit is filed every two seconds in the United States. But few of us seriously consider the possibility of a lawsuit or other legal action against us in our daily lives. The vast majority of lawsuit defendants never thought it would happen to them. Developing an asset protection plan is a ... Developing an Asset Protection Plan

Employee Spotlight: Meet the Team Member (Ryan Csrnko)

This is the latest in a continuing series of posts where we feature a member of our team using a Q&A format so you can get to know them a little better – both personally and professionally. This week we’ll be interviewing Ryan Csrnko, who joined Brown and Company in June of 2017 as a ... Employee Spotlight: Meet the Team Member (Ryan Csrnko)

Infrequently Asked Questions for Business Owners

As wealth advisors, one of the most valuable things we do for our clients is prompt questions that they are not already thinking about. We are all aware of the concept of FAQs or Frequently Asked Questions, but we would emphasize the importance of “Infrequently Asked Questions” as well. It’s often the things you don’t ... Infrequently Asked Questions for Business Owners

Top 10 Year-End Planning Ideas for 2019

As we approach the end of the year, it is always beneficial to establish and review financial goals to determine whether any additional actions should be taken. Any ideas we’ve included here take place subsequent to legislative changes that occurred two years ago with the passage of the Tax Cuts and Jobs Act (TCJA). It ... Top 10 Year-End Planning Ideas for 2019

Employee Spotlight: Meet the Team Member (Mary Radke)

This is the latest in a continuing series of posts where we feature a member of our team using a Q&A format so you can get to know them a little better – both personally and professionally. This week we’ll be interviewing Mary Radke, who joined Brown and Company in April of 2019 as a ... Employee Spotlight: Meet the Team Member (Mary Radke)

How Do You Plan for Goals That Are at Cross-Purposes?

Goal setting is at the heart of financial planning and, yet, frequently one of those goals has the potential to undermine another one. Consider a few common examples: I want to retire as soon as possible, and I want to pre-fund my children’s college education costs. I want to gift appreciated stock for tax purposes, and I need ... How Do You Plan for Goals That Are at Cross-Purposes?

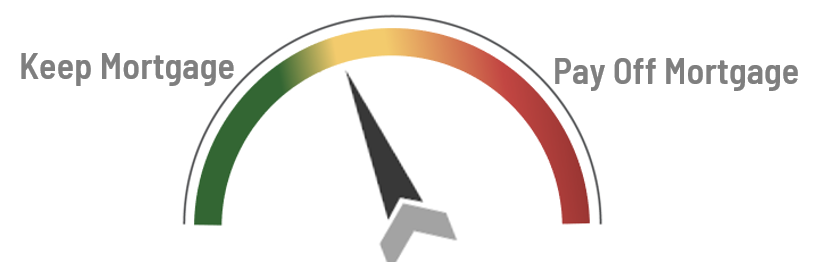

Should You Pay Off Your Mortgage?

One of the most common questions we get from clients is whether they should pay off their mortgage as they near retirement. Like so many questions, the answer is “it depends.” But that doesn’t mean it has to be difficult to determine the right answer. We believe in using a simple methodology we call the Debt ... Should You Pay Off Your Mortgage?

Three Common Misconceptions About Medicare

One of the most prominent areas of concern for those nearing retirement is the cost of health care. For those who are age 65 or older, Medicare can play a crucial role in addressing this issue. However, the system is quite complex and can feel overwhelming to figure out all its various aspects. We’ll look ... Three Common Misconceptions About Medicare

Employee Spotlight: Meet the Team Member (Erin Buis)

This is part of a new series of posts where we feature a member of our team using a Q&A format so you can get to know them a little better – both personally and professionally. This week we’ll be interviewing Erin Buis, who joined Brown and Company in February of 2017 as Director of ... Employee Spotlight: Meet the Team Member (Erin Buis)

A Legacy That Really Matters: Resume Virtues vs. Eulogy Virtues

Often the focus of estate planning begins and ends with the execution of proper documents and the titling of assets. However, a proper estate plan should not be limited to those who have passed away and the avoidance of a death tax. Instead, its most important goal should be to provide “A Legacy for the ... A Legacy That Really Matters: Resume Virtues vs. Eulogy Virtues