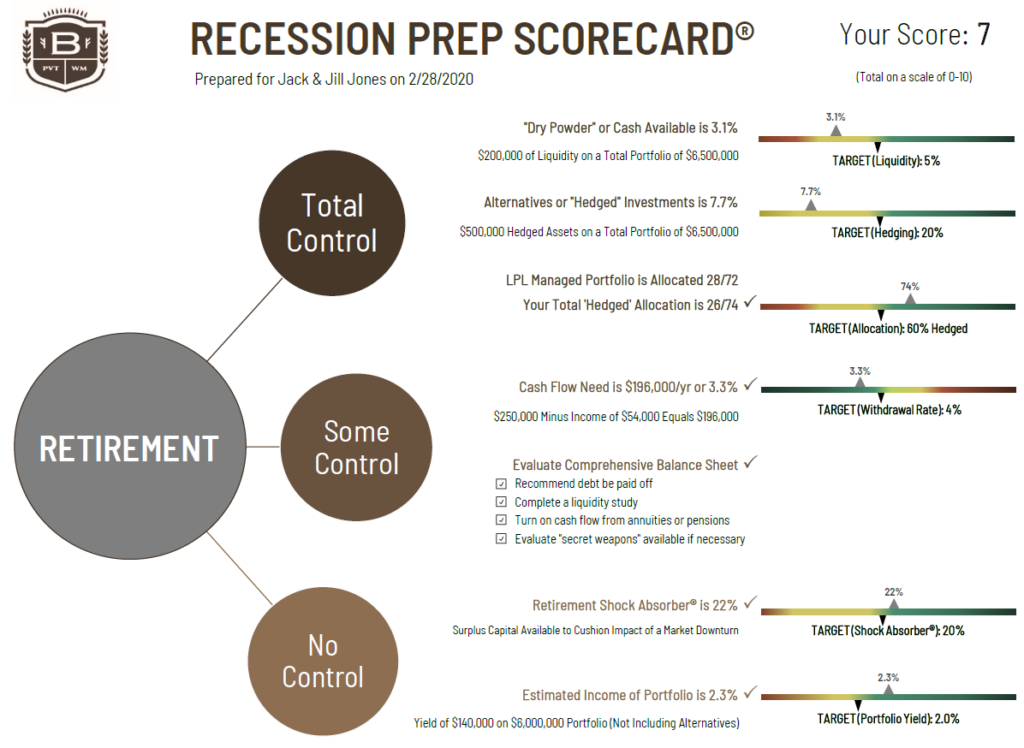

Wondering how your portfolio would fare in a recession? With the Recession Prep Scorecard®, we not only provide you with an answer but also take proactive steps to adjust your portfolio based on your individual score. Your score guides us in tailoring advice to your specific situation, ensuring you’re better equipped to navigate the uncertainties of a potential economic downturn. With our Recession Prep Scorecard®, your prep work is ongoing, with regular score updates recommended as the market or your personal circumstances change.

At Brown and Company, we’re committed to ensuring you know exactly how a recession could impact your retirement. We go beyond awareness — we actively prepare your portfolio to cushion the impact, giving you the confidence to face the future.