The best financial advice always originates from good questions. Conversely, missed opportunities and poor advice often stems from conversations that never happened because the right questions were never asked. We’ve developed a new tool for business owners called the Buyout Barometer™ that is intended to prompt the types of questions that are crucial to consider, but might otherwise get overlooked. The tool addresses those types of infrequently asked questions that help diagnose your preparedness to exit the business. Here are just a couple examples:

- Have you done any planning in advance of a potential sale that could enable you to reduce your tax liability?

- Are you aware of the most common pitfalls business owners make when selling and ways to avoid making similar mistakes?

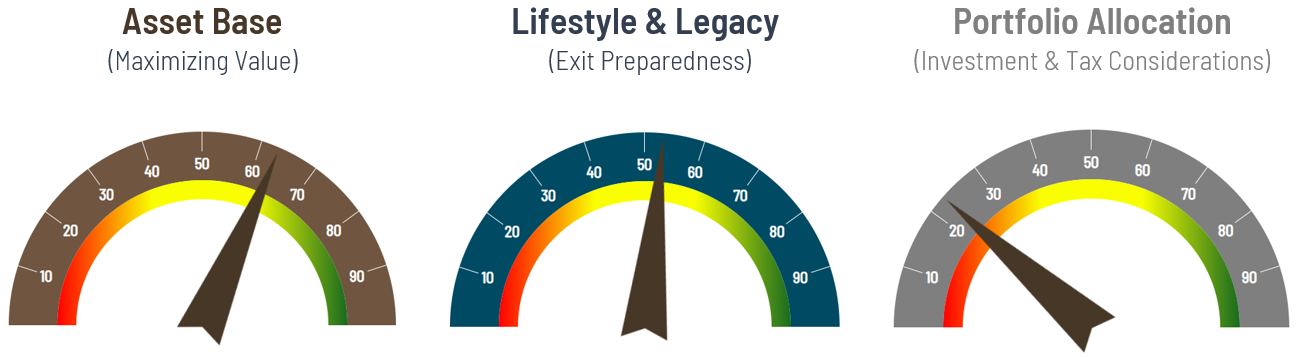

- Asset Base (Maximizing Value) - This section is designed to gauge your confidence in the current value of the business and various ways to grow that value. Considerations include processes and systems that enable scalable growth, diversification of client base, and retention/motivation of key employees.

- Lifestyle & Legacy (Exit Preparedness) – This relates to the business and how ready it is to be transitioned to new ownership as well as how prepared you are personally to exit the company.

- Portfolio Allocation (Investment & Tax Considerations) - The questions in this section are designed to gauge how financially dependent you are on the business. It also assesses opportunities you have capitalized on to minimize taxes prior to a future transition of the business.

Instructions For each of the aforementioned topics, there are five corresponding questions or statements on the assessment, for a total of 15 questions you need to answer. Each of these requires an answer that ranks your level of agreement on a scale from 1-6. A score of one means you have not done any work in that area or are answering strongly ‘no’ to the question or statement. A score of six should be reserved only for those areas for which you are in complete agreement. Ultimate Objectives The initial assessment provides a synopsis of results that you can see immediately after you provide your answers. These initial results are meant to provide you with high level feedback. They should give you a sense of where you need to be focusing more attention in order to prepare for a successful retirement. The bigger goal is to help you to achieve the following two objectives (click on either to get more details):

- Prepare Your Business for Transition - The energy you spend growing a business is largely futile if the business is not properly transitioned and its value fully realized. In a study of 300 former business owners who recently sold their companies, only 25% felt the sale accomplished their personal and financial objectives.

- Prepare You and Your Family for Life After the Sale - An entrepreneur’s emotional attachment to their business cannot be overstated. Many business owners are not emotionally prepared for life after the sale and fear the loss of stable income. According to our conversations with a number of investment bankers over the years, this is a big reason why many deals fall apart.