Latest Insights

Brown and Company Keeps You Posted

Falling Interest Rates

The Federal Reserve announced its expectation not to raise short-term interest rates any more in 2019, reflecting a more subdued forecast for economic growth in the remainder of the year. Previously, the Fed had indicated that it expected to hike short term rates by a quarter percentage point twice more in 2019. The current Fed ... Falling Interest Rates

Barron’s 2019 Conference Recap

Martin Walsh attended the Barron’s Team Summit in Las Vegas in early February. The conference is an invitation-only event, aimed at recognizing the achievements of the top financial advisors in the United States. Mark R. Brown has been a perennially leader in Colorado atop the Barron’s Top 1,200 Advisors list. An annual event which Brown ... Barron’s 2019 Conference Recap

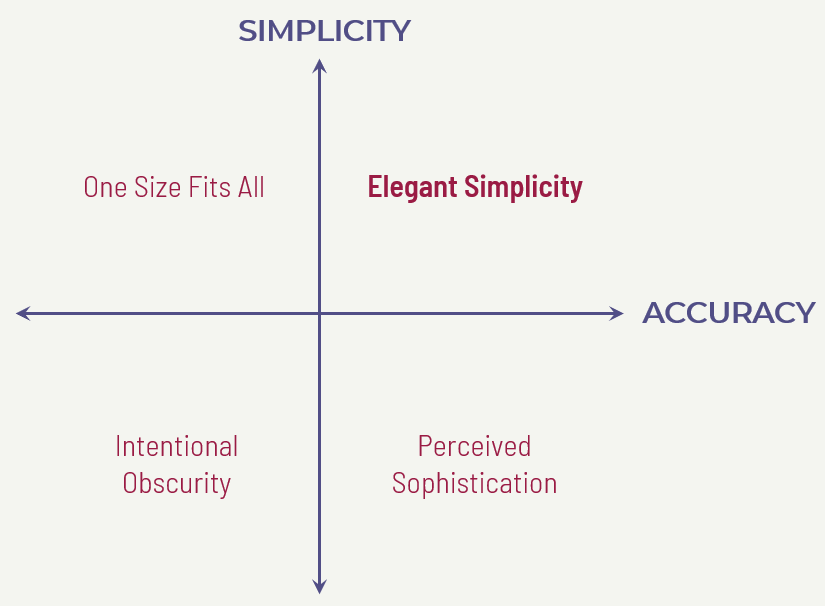

Challenges and Benefits of Simplicity

In a world of increasing complexity and unprecedented technological advancement, it is easy to feel overwhelmed. As a result, simplification can be a real gift. Ask anyone who has recently tried to research and enroll in health care benefits, and they will gladly accept an expert’s offer to simplify all of it. When done well, ... Challenges and Benefits of Simplicity

When to file for Social Security benefits?

The question of when to file for Social Security benefits is a frequent topic of conversation with our clients. Even with ultra-high net worth clients, the value of the income stream from Social Security is large enough to warrant a careful discussion. Indeed, the capitalized value of an inflation-adjusted income stream that pays several thousand ... When to file for Social Security benefits?

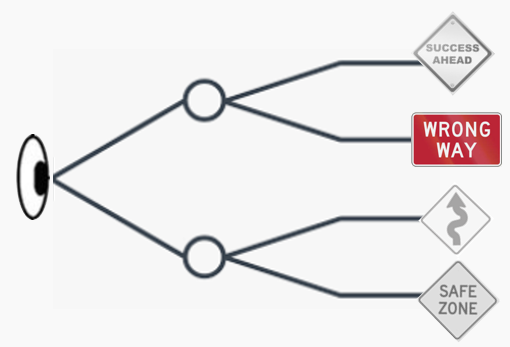

Upfront Hindsight: Anticipating Problems Before They Occur

One of the most common descriptions of financial planners and advisors is that we are problem solvers. But while it is certainly true that advisors need to be able to solve problems for clients, we would argue that the value of problem solving is not what it used to be. The greater value an advisor ... Upfront Hindsight: Anticipating Problems Before They Occur

Why Do-It-Yourselfers Become Delegators

Historically, financial advisors have tended to think of two broad categories of investors: do-it-yourselfers and delegators. Delegators tend to seek out advice and are willing to pay for it. Whereas, DIY types are less inclined to see the value of wealth advice and, therefore, are less willing to hire someone to help them. That’s the ... Why Do-It-Yourselfers Become Delegators

Financial Planning for Widows: Do You Have a Plan If Your Wife Survives You?

We see a very common fact pattern among retired couples, a potential pitfall that can lead to unintended consequences if not planned for appropriately. Often, a husband has been the primary breadwinner for a family and has been the dominant decision maker on most financial decisions of consequence. These financial decisions include hiring a wealth ... Financial Planning for Widows: Do You Have a Plan If Your Wife Survives You?

Should You Hire a Wealth Advisor?

As technology has improved and it has become increasingly easier to open accounts and invest money in a diversified portfolio, people are often asking whether financial advice is worth paying for. Or, more specifically, what is the value of financial advice? The answer ultimately depends on what type of advisor you are considering hiring and ... Should You Hire a Wealth Advisor?

Are We Headed For Another Recession?

There has been much doom and gloom predicted for the stock market looking ahead to 2019, at least in some corners of the investment world. Much of the volatility in the market that we witnessed at the end of 2018, and the ensuing pessimism from investors, is predicated on a potential economic recession for the ... Are We Headed For Another Recession?

Falling Interest Rates

Intermediate and long-term interest rates have fallen significantly in the past few months. For those who have yet to lock in long-term mortgage financing on their home, the recent decline in yields represents a new opportunity to lower their monthly mortgage payment. As financial advisors, we are continually looking for ways to improve the financial ... Falling Interest Rates

Putting an Extremely Volatile Market in Perspective

On Monday, the S&P 500 Index came about as close as possible to the technical definition of a bear market without officially registering one (defined as a 20% or larger decline based on closing prices). Enduring these sharp declines can be unnerving for any investor, making it difficult to avoid the urge to react and ... Putting an Extremely Volatile Market in Perspective

Ben Bernanke Speaks In Denver

Mark Brown and the Brown and Company team attended a luncheon with Former Fed Chairman Ben Bernanke in Denver on November 28th. Dr. Bernanke is now an advisor to PIMCO, one of the largest fixed income managers in the world. The lunch was a forum put on by PIMCO in order to better understand Chairman ... Ben Bernanke Speaks In Denver