Latest Insights

Brown and Company Keeps You Posted

Traits of Successful Entrepreneurs

We all love stories of originality and innovation. Who isn’t inspired by the entrepreneur who was willing to risk it all and, against all odds, succeeded? We all want to hear about the person with strong convictions who swam against the tide, and we want to copy the traits of successful entrepreneurs. But there’s a ... Traits of Successful Entrepreneurs

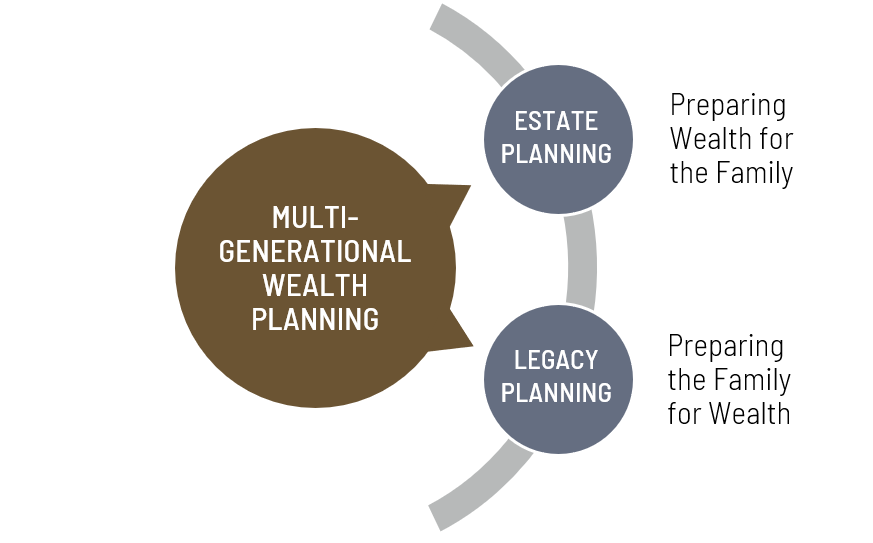

Redefining Legacy: It’s Not Just What You Leave Behind

If we’re fortunate enough, there comes a point in our lives when we begin thinking less about the things we are doing today and more about the things we want to leave behind. The idea of creating a meaningful and enduring legacy is a powerful one. A legacy isn’t merely a financial arrangement that comes ... Redefining Legacy: It’s Not Just What You Leave Behind

The Risk of Rising Interest Rates

Interest rates remain near all-time lows. Since September of 1981, the Federal Reserve has guided 10-year Treasury rates from a peak of 15.84% to a low of 0.55% in July of 2020.1 This decline has been engineered in keeping with the Fed’s “dual mandate” to manage employment rates and inflation through rate adjustments; using rate hikes ... The Risk of Rising Interest Rates

Creativity Starts with Empathy

One of the wisest sayings is “The more I learn, the less I know.” In 1817, the poet John Keats wrote, in a letter to his brother, about how the world is far more complex than we could ever imagine. Due to our limited experience and perceptive abilities, we only glimpse a small portion of reality. ... Creativity Starts with Empathy

Top 10 Year-End Planning Ideas

As we approach the end of the year, it is always beneficial to establish and review financial goals to determine whether any additional actions should be taken. Here are the top 10 year-end planning ideas that we discuss with our clients that should consider. 1 – ESTABLISH FINANCIAL GOALS – The end of the year is ... Top 10 Year-End Planning Ideas

3 Tax Strategies to Consider at Year-End

With the year rapidly coming to a close, and the upcoming tax year looming with uncertainties, you should consider updating your tax strategy to best preserve your assets into the future. Don’t wait until the end of the tax year to make these adjustments. Check out some of the tax strategies below then reach out ... 3 Tax Strategies to Consider at Year-End

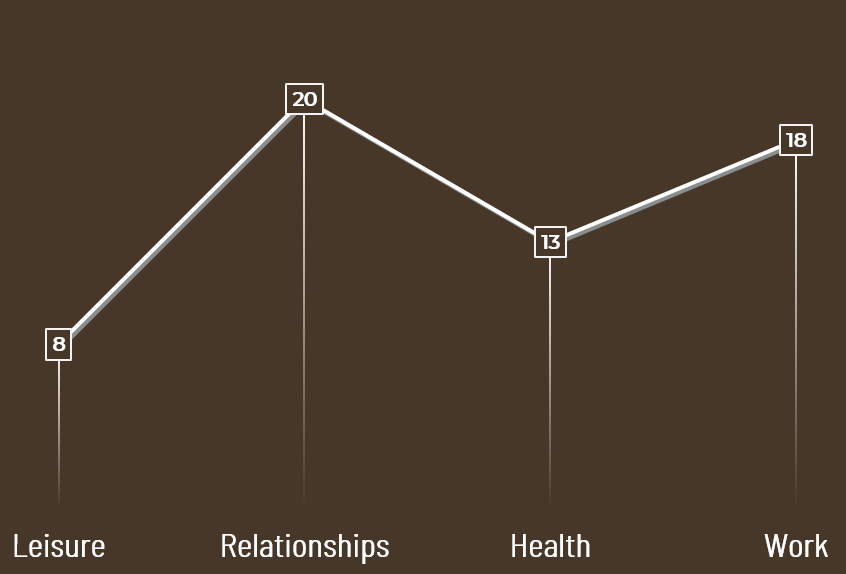

Redefining Retirement: Take Our Free Assessment

As a wealth management firm, our objective is to not only help clients reach their goals, but also define those goals as well. For instance, if one of your goals is to retire at age 62, we could not help you actually achieve that goal unless we know what “retirement” means to you. Often that ... Redefining Retirement: Take Our Free Assessment

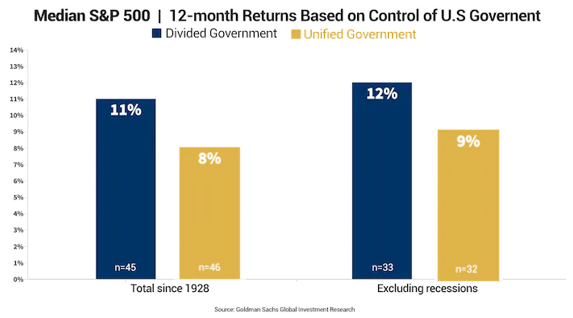

Post-Election Commentary: Impact on the Markets

In the month leading up to the election, we held our Fall Lecture Series of webinars (click here to watch the replays). Now, we want to provide our commentary on what has transpired since Election Day and consider how that might impact the markets going forward. Here are some thoughts about what the election results ... Post-Election Commentary: Impact on the Markets

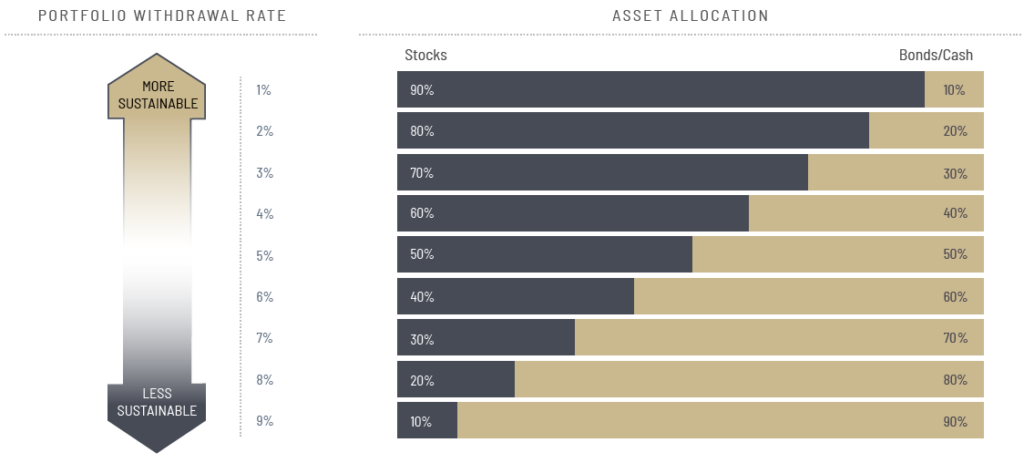

Personal Finance Needs to Be Personalized: Why Rules of Thumb Are Misleading

If you are trying to figure out how much you need to save for retirement or determine how much life insurance you should have, financial rules of thumb can be a helpful starting point. But as your situation becomes more complex and your level of wealth grows, rules of thumb can go from being helpful ... Personal Finance Needs to Be Personalized: Why Rules of Thumb Are Misleading

GRATs: A Planning Tool for Business Succession

For today’s business owner, continuation and estate planning go hand-in-hand. Without proper tax strategies, the time, hard work, and money you’ve invested in your business could yield little more than a significant tax bill for your heirs. Fortunately, with careful planning, there are numerous ways of reducing your family’s tax burden while keeping your business ... GRATs: A Planning Tool for Business Succession

5 Key Estate Planning Questions

Estate documents should be reviewed regularly to ensure that they are up-to-date and still adequately express your wishes pertaining to the distribution of your estate. We believe there are five key estate planning questions to consider. Before meeting with an attorney to update your current estate plan, you should consider these strategic questions regarding how ... 5 Key Estate Planning Questions

Business Contingency Planning for Small Business Owners

There comes a point in time when almost every small business owner contemplates the future of his or her business. Because the business typically is a substantial asset, an owner must address a number of estate planning issues that will affect the future stability of the company. A business succession plan is a comprehensive look ... Business Contingency Planning for Small Business Owners