Latest Insights

Brown and Company Keeps You Posted

Did the Pandemic Speed Up Your Business Succession Plan?

66% of business owners stated that the Pandemic sped up any plans they had to sell their business Only 1 in 5 owners surveyed, stated that they met with their wealth manager about the process We are here to help with our proprietary tool, The Buyout Barometer® When 2019 ended and 2020 started, no one ... Did the Pandemic Speed Up Your Business Succession Plan?

Employee Spotlight: Meet the Team Member, Ellewynn Tieszen

This is the latest in a continuing series of posts where we feature a member of our team using a Q&A format so you can get to know them a little better – both personally and professionally. Ellewynn is originally from Yankton, SD. She studied Musical Theatre at the American Musical Dramatic Academy in New ... Employee Spotlight: Meet the Team Member, Ellewynn Tieszen

2021 Mid-Year Market Outlook Webinar Replay

2021 Mid-Year Outlook Webinar Now Available LPL Financial Chief Investment Officer Burt White joins Mark Brown for a discussion on the outlook for the 2nd half of the year. Key Discussion Points: Why is the market hitting all time highs when the news is not that great? Covid: The fastest recession ever? Average length of ... 2021 Mid-Year Market Outlook Webinar Replay

Fourth Quarter Earnings Boom

Here Comes The Earnings Boom LPL Research reviews an incredible earnings season and speculates on a potentially strong earnings rebound for 2021 and beyond. Find out more in today’s Weekly Market Commentary, available at 1 p.m. ET. Daily Insights US stocks open higher after last week’s bond market volatility subsides Europe’s Stoxx 600 Index rises the most in three ... Fourth Quarter Earnings Boom

One Year Later: 3 Lessons Learned Since the Market Peak

We like this recent blog out of LPL research and thought we would share with you…it will sound familiar as of our most recent client note from Mark. Today marks one year since the market began to price in the effects that COVID-19 would have on the world. The old market adage “stairs up, elevator ... One Year Later: 3 Lessons Learned Since the Market Peak

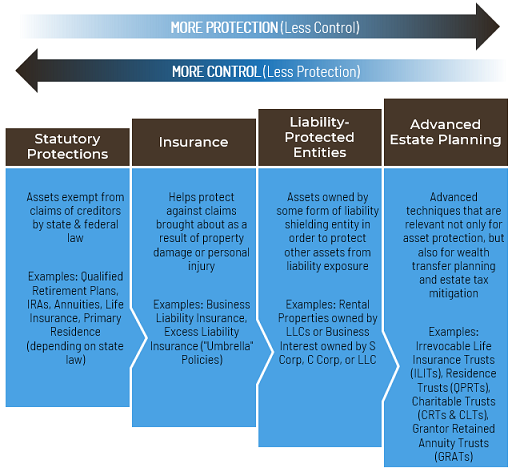

Developing an Asset Protection Plan

On average, a new lawsuit is filed every two seconds in the United States. But few of us seriously consider the possibility of a lawsuit or other legal action against us in our daily lives. The vast majority of lawsuit defendants never thought it would happen to them. Developing an asset protection plan is a ... Developing an Asset Protection Plan

How Charitable Giving Can Benefit Donors

Kelly and Bob regularly set aside a small portion of their budget for charitable donations. In addition to feeling good about supporting a number of worthy causes, they’ve been able to deduct the value of their charitable gifts from their Federal income tax return. Now, the couple thinks it is time to make a larger ... How Charitable Giving Can Benefit Donors

Traits of Successful Entrepreneurs

We all love stories of originality and innovation. Who isn’t inspired by the entrepreneur who was willing to risk it all and, against all odds, succeeded? We all want to hear about the person with strong convictions who swam against the tide, and we want to copy the traits of successful entrepreneurs. But there’s a ... Traits of Successful Entrepreneurs

Redefining Legacy: It’s Not Just What You Leave Behind

If we’re fortunate enough, there comes a point in our lives when we begin thinking less about the things we are doing today and more about the things we want to leave behind. The idea of creating a meaningful and enduring legacy is a powerful one. A legacy isn’t merely a financial arrangement that comes ... Redefining Legacy: It’s Not Just What You Leave Behind

The Risk of Rising Interest Rates

Interest rates remain near all-time lows. Since September of 1981, the Federal Reserve has guided 10-year Treasury rates from a peak of 15.84% to a low of 0.55% in July of 2020.1 This decline has been engineered in keeping with the Fed’s “dual mandate” to manage employment rates and inflation through rate adjustments; using rate hikes ... The Risk of Rising Interest Rates

Creativity Starts with Empathy

One of the wisest sayings is “The more I learn, the less I know.” In 1817, the poet John Keats wrote, in a letter to his brother, about how the world is far more complex than we could ever imagine. Due to our limited experience and perceptive abilities, we only glimpse a small portion of reality. ... Creativity Starts with Empathy

Top 10 Year-End Planning Ideas

As we approach the end of the year, it is always beneficial to establish and review financial goals to determine whether any additional actions should be taken. Here are the top 10 year-end planning ideas that we discuss with our clients that should consider. 1 – ESTABLISH FINANCIAL GOALS – The end of the year is ... Top 10 Year-End Planning Ideas